TLDR Trades for Friday 1/20:

Thursday’s results from the watchlist:

Today was another slow day. We got a bit more movement and some good moves off support levels which made things easier than Wednesday, but still, difficult trading conditions. On days like today, entries become super super important. If you trying to take profits and 30%, 40%, wherever, you need to be precise and not chase, because price may not get up to your 30% profit taking level if you chase and enter 10% higher than the trigger. Does that make sense? Ask me questions if you need further insight into this.

Looking at the broader markets of the S&P500 and the NASDAQ, super important levels held today. Let’s dive in…

#ES Futures:

Upside: 4020*, 4050, 4080, 4110, 4180*

Downside: 3975, 3950, 3915*, 3860, 3810, 3775*

I’ve been talking about the 3915 level for weeks. We keep coming back to this area. Zooming out back to May ‘22, you get an idea of how many flips of support and resistance we’ve seen. Price continues to oscillate around this level.

Back to today, it was extremely positive today we held 3900 and closed over 3915. If we continue higher and go green tomorrow, I believe we will be in for another major trend line test next week. Further, the QQQ also held a similar important level at 275. QQQ still needs a little more work vs S&P500 to really make a run over that trend line.

Again, as the dips get shallower and shallower, the hits get more frequent, this all leads up to an eventual break. The major trend line is on watch by just about everyone…when that happens it takes time and energy for a level and sentiment to change.

for reference:

Upside: 399*, 403, 407, 411*

Downside: 390*,387*,383*, 378, 374*,370

Upside: 279-280*, 285*, 293, 297*

Downside: 275*, 270*, 266, 260*

As mentioned, QQQ followed the S&P by closing above important levels. There have been glimmers of hope in growth stocks and big tech. Further, ER was received positively. Let's see if this helps pull the NASDAQ more in line with the S&P.

For tomorrow, I would like to see the QQQ get back into that parallel channel. This allows us to setup for the QQQ to test the trend line in a similar time frame to $SPX.

If we reject off the bottom line, that would be a confirmation backtest and make things lean more bearish. It may just be a divergence of $SPX and so more time and information may be needed. Don't get ahead of yourself and trade the price action in front of you.

Onto the trades for tomorrow…

I’m not seeing a ton of good setups out there. We are in this back and forth consolidation zone and it causing some ugliness in the charts. We could very well miss a big move if the market pops or drops fast because of this. I’m ok with that. I want to be confident in what I’m seeing and not just “pick a direction” for a given trade.

Just on watch for tomorrow. I want to see how price reacts and if it holds 135. If we do get a pop higher, clearing 137-138 will be very positive. I mentioned in a tweet this morning that many traders (including myself) use Apple as a proxy for the rest of the market. If AAPL shows strength more of them than not, so will the rest of the market. Another price point I’m watching is a pullback to 132-133. If the market is somewhat strong and this area holds, again, positive showing buyers stepping in at key support levels. I may or may not take a trade intraday tomorrow on this one. Just need to see what the price action is like tomorrow.

Backtest Trade Idea: 67ish holds 68 call

The semis, specifically AMD and NVDA haven’t been looking great the past two days. But, we those names were in need of a pullback. AMD looks better at this backtest level vs NVDA. NVDA options premiums are also very elevated right now.

I would approach the size on this trade knowing it could go to zero. Or make sure you are tight with your stop under 67. I wouldn’t give it much wiggle room. Given that it’s Friday, I will most likely size it as a “can go to zero” trade.

Trade Idea: 51c>50 Lotto!

Crypto market. What else is there to say other than it’s volatile. Coinbase has nearly doubled since the start of the year. We got a major pullback off resistance at 58 yesterday and then it looked like we were going big red again but price recovered. Now that Friday is here, the premiums are more forgiving for a trade. 50 is still the big level to clear and with the volatility I only like this for a lotto trade.

Rejection Trade Idea: Rejects off 94 take 93 put

Google is coming right up to a major supply/resistance zone. The price action on this one has been really choppy. Red bar, green bar, green bar, red bar. Blah blah blah. I tend to avoid tickers when they do this, however, the 94 area is really strong resistance. Further, there’s a bit of a rising parallel channel in play. Enough of a negative looking setup to make a short trade work. If the whole tech sector is showing strength tomorrow, I would hold off on this one. But, just the opposite, if tech sells off, this could be one of the bigger winners.

Trade Idea: 139c>137.45

Little less risk choice: next week Jan 27 143c>137.45

META showed really nice relative strength today. After the gap down, it was pretty much straight up since the opening bell. Further it setup really nice for Friday by coming right up near the trigger point at 137-138. This setup looks really good. I’ll probably size heavy into this one of the market cooperates. If we gap over 137.34 in the morning, taking a trade over 138 is also an option. If we get a big gap up, that would be a bummer…if that’s the case, I would wait for a backtest of 138ish to get in

On Watch: Rejection at 172 take 170 put. Only if options premiums come down and tech/semis show weakness

I’m longer term bullish on NVDA. However, with price bouncing around a bunch the past few days, I’m more inclined to take a short take off a resistance level. I want to see more consolidation and development before going long. If I do wind up taking a short trade on NVDA, I won’t give it much room. It could very easily hit 172 and continue higher to test 176-177. With the premiums being elevated and the possibility of going thru 172, I want everything to line up on this one before taking it.

Trade Idea: 89p<90

Similar idea to yesterday. Options premium on PDD are super cheap. Even a 1 point move should yield a good results since its Friday. We’ve got this rising wedge, hitting key support levels at 90, all good things for a short trade. If we do break below this wedge, we could see a 2-4 point downward run, which would be a massive win.

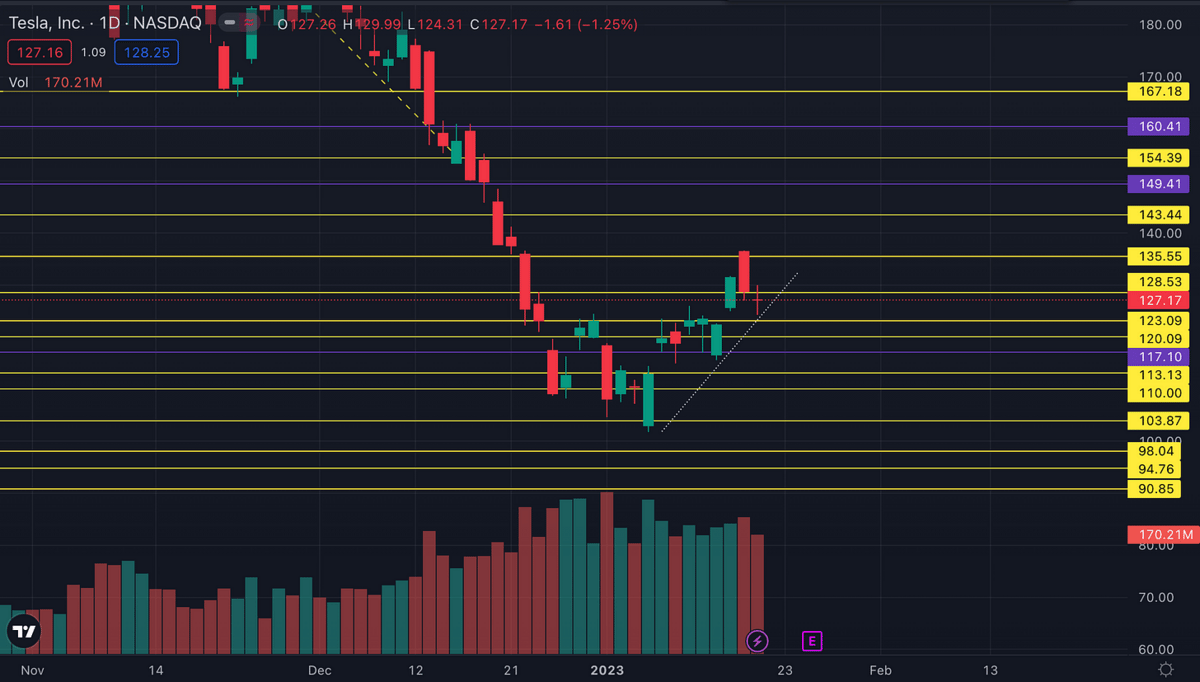

Trade Idea: 120p<124 small sized position

A bit on indecision on this Tesla. We got a dojo today right above the 123-124 support level. I’m willing to take a lotto shot under 123-124. The option’s premiums are cheap enough to make a trade work with a 2-3 point move. This doesn’t have to be a lotto trade, but I wouldn’t size up huge either. Conservative play would keep it on the smaller size…say 1/4 of your normal position.

Good Luck and Happy Trading! Any questions, shoot me a DM on Twitter!