First up, the day’s results. Turned out to be a good open to grab trades, then everything fizzles out and we chopped around all day. You don’t have to trade all day. If you make some good trades and the markets turn into choppy garbage the rest of the day, just walk away and do something else.

TLDR WEDNESDAY WATCHLIST:

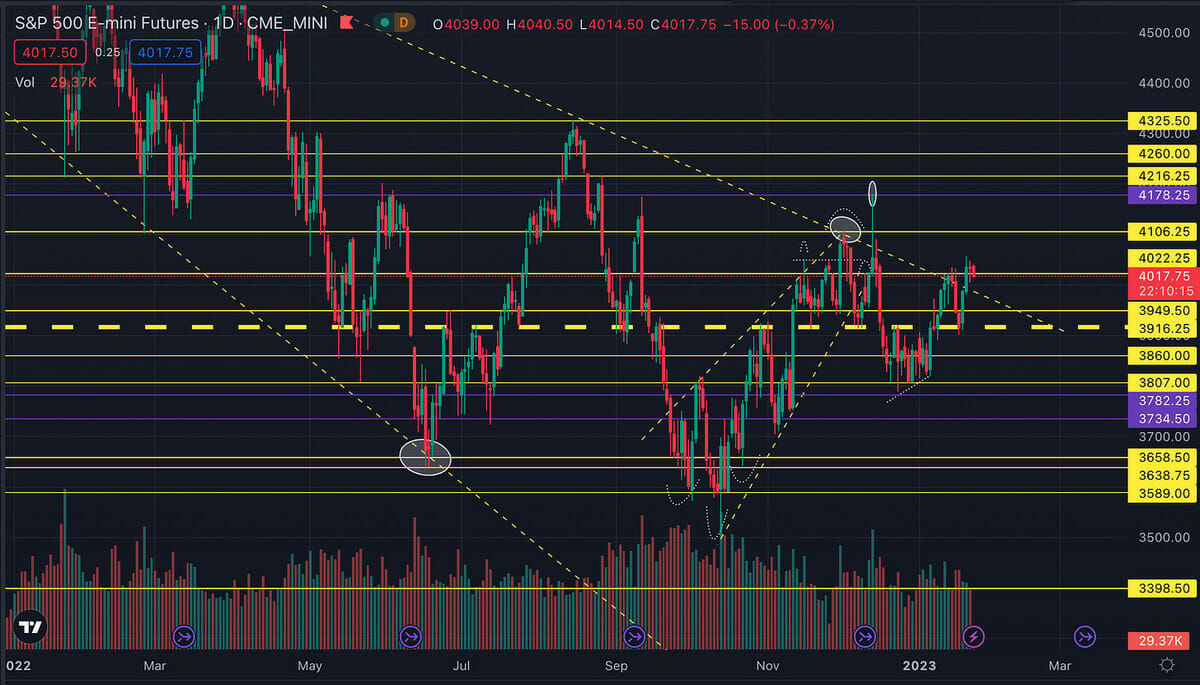

#ES E-Mini Futures

Upside: 4050, 4080, 4110, **4180**,4215

Downside: 4020*, 4000,3980-3975, 3950, 3915*, 3860, 3810, 3775*

Just zero movement today. The bears attempted to push below 4000 but buyers stepped in right at 4000 and we held. Although today’s action was boring boring boring, it was constructive and proved we have some upward strength. #ES closed above the all important 4020-4030 area with this boring inside bar. Again, I’m not saying we don’t drop below 4000 at some point…I actually think we will some time soon. What’s important is how those levels respond. Do we just dart lower? Or do buyers step in at important levels along the way. Time will tell and my bias is still bullish.

Lastly, we do have big tech earnings starting. ER showed an initial big pop but has since died off and now under the levels at the market close. Just have to wait and see what happens at the open tomorrow.

Reminder ER after the bell tomorrow.

Upside: 403, 407, 411*, 417

Downside: 400-399*, 397, 393, 390*,387*,383*, 378, 374*,370

Simliar story on SPY. We dropped and 397 held then we closed above 400. Positive signs. We need more days to see how this all plays out and what forms up.

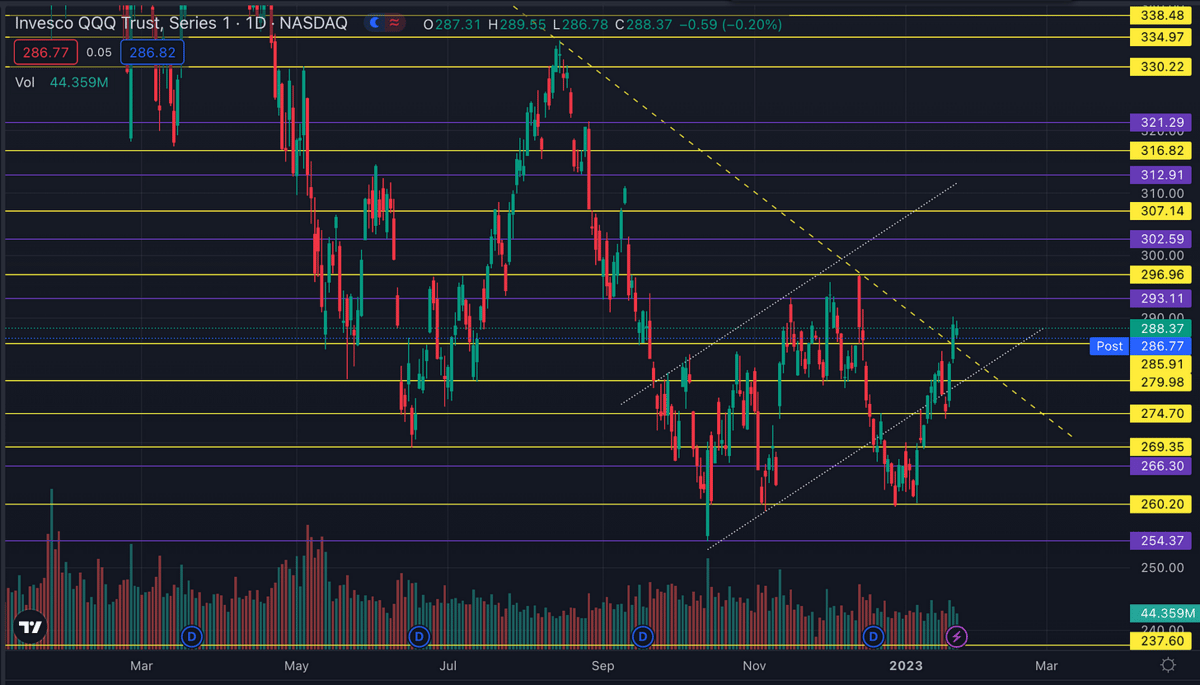

Upside: 290, 293, 297*, 302

Downside: 288,285*, 275*, 270*, 266, 260*, 279-280

Trade Idea: 290c>289

Tech and the NASDAQ looked the strongest of the bunch today. While we didn’t quite test yesterday’s highs, we still closed green with a fairly strong inside bar, given the chop. Big tech is setting up nicely assuming earnings and/or the Fed don’t screw things up.

Trade Idea: 77c>75

AMD had a bit of an up and down day but still closed green via an inside bar. The premium cost has really come out of the options contracts so a 1 point move should yield about 50%. Normally, I wouldn’t go after this trade since I don’t believe it can run, however, seems like an easy 50% if the stock can move in our favor. If I take the trade, I will most likely take the majority of the position off the table at a 50% move, or so, and leave like 25-33% left for runners.

Trade Idea:100c>98

This is turning into one of those trades that seems like it’s never going to work and as soon as you give up on it. Bam. It breaks higher. I’m gonna keep trying on this one. I don’t like a backtest trade on Amazon. I want to see upward speed, volume, and momentum driving it higher. Option’s premiums are also cheap on this one, similar to $AMD, a single point move should make the trade work. I’ll try and be patient to wait for a strong breakout over 98.

Trade Idea: 122c>120

Finally got a few days on consolidation on some of the Chinese stocks. Price has stalled out right below 120. 121 is more of the resistance line, but, given option’s premiums being cheap, I’m willing to take a shot early below my resistance level. We will probably need a 1.5-2 point move to get 50-60%. So this trade may need to be managed more actively if it can’t clear 120 with momentum. If 120+ gets rejected hard, I will try and exit quick and not wait for a stop below say 119.

Trade Ideas: 58c>55 lotto!

On watch <53 for puts lotto!

Anyone else tired of crypto? Just make the laws already. Tried of all the up, down, FTX scandal, pump this, blah blah blah

For Coinbase, we’ve got the early signs of a bull flag forming up. Over 56, could see 58ish and I would expect price to stall out or reverse around 58. Very big resistance zone. If we only get a 1 point move from 55 to 56, the trade will probably yield about 30-35%. While not great, if the market is slow could make for an easy trade.

Downside is also interesting. Below 53, could very easily see 50. I’m just watching downside for now to see how the broader market fairs tomorrow along with Bitcoin and the crypto markets. But if we do see a quick sell off, I’ll be looking at 50 puts below 53ish.

On Watch>109

Just on watch to see how price reacts at 109. Today, we hit the major resistance level right at 109 and reversed pretty hard. With price closing at 104+, I don’t like taking a trade over 109 (unless we see a face ripping rally tomorrow). Going from 104-111+ is a massive one day move so I’d rather see if it sets up to the 107-108 area and, hopefully, a trade lines up for Thursday or Friday.

Rejection Trade Idea: 57p on 61+ish rejection. On watch <59.23

DoorDash broke over that downward trendline really nicely and has been on tear since. It’s starting to hit a bigger supply/resistance area. If price shoots over 61.5 or so with momentum, I won’t take this trade. We could actually see it run above 62 on strength. But if the market is slow or weak, I like the rejection trade.

I’m a little torn on taking the trade on a breakdown below today’s lows around 59. I think the trade would only be good for 2 points before bouncing off both the downward trendline and the support line at 57. Buuuuttt, a 2 point move is worth 75-85% since options premiums are cheap. What to do what to do? It may be a more feel type trade based on how tomorrow’s open goes. Meaning if things look weak and the open is weak, take the trade under 59.

Rejection Trade Idea: 21p on 22 rejection lotto!

Meme stocks! Meme stocks! They move up and down just like any other stock. Anyway, we have a small double top formed up right around 22. Price was unable to get over yesterday’s high at 22.5ish nor last week’s high, just over 22. This 22 level has become good sized resistance and with the data points just mentioned, it’s worth taking a lotto shot if price gets up to 22 and rejects. I’m willing to try 21 puts just over 22. Say up to 22.15ish, but, if we blast thru 22, I’ll put this trade off to the side.

On Watch>100

Similar idea to Crowdstrike…Google is typically a slow mover. Getting over 100 could be a good trade, I just don’t like it for tomorrow. The stock would need a 4-5% total move to make the options trade profitable over 100. Again, I’d like to see it setup to the 98.5-99.5 area, then be ready for a trade Thursday or Friday.

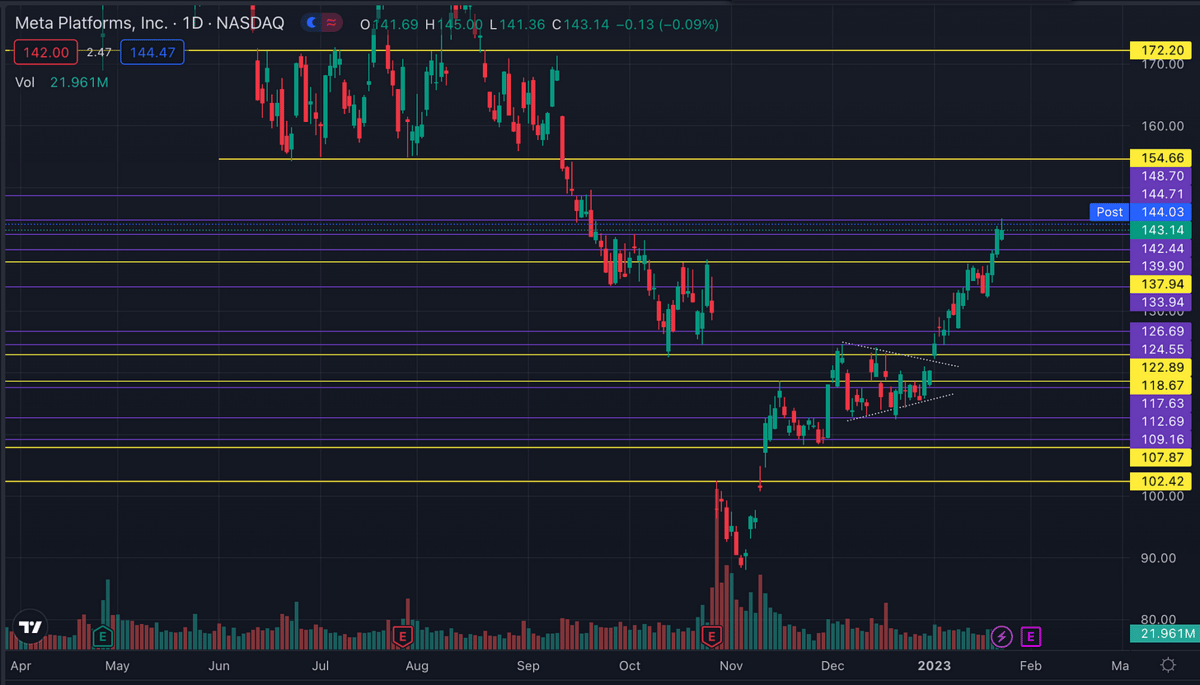

Backtest Trade Idea: 138+ holds 142c

This trade also may need some more time. If price gets down to 138ish tomorrow that most likely means the broader market is weak and falling. Depending on if it’s a strong trend or not, this trade would not be viable.

But, if we keep seeing buyers step in at key support levels, this would be the type of trade to go after. If I’m taking this trade, I want to make sure the downward support levels on #ES and/or lines up around the same time as the 138 level on META. That will give me more confidence in a bounce vs randomly taking it at 138.

On Watch for pullback trade to 355-356 possible 360 calls

Netflix continues to run upwards. I’m looking at more or less the same trade as today for tomorrow. Nothing complicated. Price comes down to 355-356 area and bounces. Tomorrow’s trade is a little more complicated because it’s a bigger retrace than today. Today’s retrace only needed 2 points, which for a stock like NFLX could happen at any time just due to random noise. A 7-8 point drop, now we are talking a 2+% move downward on the stock. Which may mean broader tech is getting hit pretty hard.

That is why this is just on watch for tomorrow. If everything lines up and the market looks strong, worth taking the trade. If market is weak or selling off, I will look elsewhere.

On Watch: 45c>44

Shopify got halted along with a bunch of other NYSE tickers at the open causing all sorts of weird candles today. I still like this trade over 44 with volume and momentum. Big bases plus a breakout typically means big moves.

However, it is a good sized move to get over 44 in one day tomorrow and with that weird candle from today, it gives me pause in jumping in on this one.

Trade Idea: 97c>96

Pulling out the erroneous candle from the halt NYSE open, I still like this one for a shot over 96. Option premiums are super cheap, so a 1 point move should easily get 50%.

One major problem with this trade is chop. If the market is choppy, this thing won’t move and it will just bleed premium. Watch broader tech and the semi sector to make sure everything is moving or trending before taking this trade.

Rejection Trade Idea: 140p on 146+ rejection

Valero has rejected 146 multiple times (excluding today’s oddball halted candle). Unless the crude oil market shows strength tomorrow, I think 146 gets rejected again. Premiums are slightly elevated due to earnings release on Friday. But, a 2 point move should still give about 50%. Yesterday we got a 3 point rejection off 146+ so a move that size should be in the cards and able to yield 50-75% without running.

Again, avoid this trade if we see a pop in energy or crude oil tomorrow at the open and thru mid morning.