TLDR just show me Thursday’s Watchlist:

As usual, today’s results first. A bit unexciting from a trigger standpoint but lots of good information we gained from the market and movement today.

#ES E-Mini Futures

Upside: 4050, 4080, 4110, **4180**,4215

Downside: 4020*, 4000,3980-3975, 3950, 3915*, 3860, 3810, 3775*

This morning we got a gap down in an up trending market. Typically, this means we either get a trend reversal or we get a “buy the dip” opportunity. As the market broke thru the 3875-3880 major support level and headed for the next support level at 3950-60, it was a little unclear which way things were headed. Well, we didn’t quite get down there as buyers stepped in big time.

Pre Market I was planning on a “buy the dip” type open and we got that. However, as the market broke below 3980, I switched to more neutral, wait and see. Here was my premarket tweet:

I saw a bottom starting to form once support started to show up just above 3960. I did take some $SPX 0DTE calls for a nice win. How did I know it was going to reverse? I didn’t. I took a trade based on the market making a higher low off the bottom, then breaking thru the open intraday/major resistance at 3975ish. It could have just as easily reversed back lower off those levels. That is why it’s important to position size. I had a small position. If it didn’t work, oh well, let it go to zero and try something else.

As the day played out, every dip got bought. Most, if not all, major stocks reversed and it turned into a massive short squeeze.

What does all this mean..

A quick summary of the day, we gap down, 3980 tries to hold but fails, next support level around 3950-3960 holds(these level happen to coincide with the major downtrendline), we backtest the major downward trendline and drop below, we reverse hard and get a major short squeeze going from red to flat/green, we close over the major downward trendline.

How does that series of events sound to you? Common sense usually prevails. Pretty bullish, no?

If you’re in a tug of war battle and one side continually comes out ahead, you’d bet on that side the next go around right?

That’s how I’m viewing the markets right now. We continually battle back and forth. Major trend lines and support lines get tested, yet we continue to close above. Very positive for upward movement.

How to play this? Re read my tweet. Markets don’t move in one direction. We have to be ready to load up when the squeezes and trends happen. Then be ready to dial it back when we get gap downs or chop within the broader trending market. It’s not easy to shift back and forth. But, if you want to truly grow your account, this is what you must learn. % of portfolio is different for everyone. But my number one rule is STAY IN THE GAME. You can’t play if you’re not on the game. Whether that risking 1% on a trade or 100%, know how to stay in the game.

Upside: 403, 407, 411*, 417

Downside: 400-399*, 397, 393, 390*,387*,383*, 378, 374*,370

Trade Idea: 403c>401

I know a lot of you prefer to trade SPY so here is a trade idea how I would take it. I think if we get thru 401 cleanly, 403 should come fairly quick. 401 lines up with 4050ish on #ES and I’m expecting 4100+ to be tested if we get thru 4050.

Upside: 290, 293, 297*, 302

Downside: 288,285*, 275*, 270*, 266, 260*, 279-280

Trade Idea: 291c>289

The Nasdaq and S&P500 area really starting to line up, which gives me more confidence in a potential bull run. Notice how both indices have similar looking candles and similar formations the past 3 days? Further, we got similar support and trendline tests and both QQQ and SPY/SPX held. I see no reason for short trades in strong names right now unless something drastically changes.

Trade Idea: 107c>105

We closed right below a big support/resistance level in 105. The premiums are still very cheap and given it’s Thursday, most of the time value has been sucked out. A small 1 point move on the underlying stock should yield 40-50%. And there is room to run up to 108 area which should see a 100-150% gain if that were to happen.

Trade Idea: 77c>75

75 is actually a little early on a long entry. I would prefer to wait till 76. But, options premiums are so cheap that we won’t even need a 1 point move to get 30-40%. I think we will hit some resistance at 76 so I will be ready to take at least half off the table at 76ish. If it runs past 76, 78-79 could be in the cards given the resistance areas are a little grey.

If we gap over 75, I won’t take the trade. I will either pass and look at something else or watch and see how price reacts around 76. I don’t want to buy into a resistance area that’s not super clear cut.

Trade Idea: 100c>97.24 (or >98 works also)

This is the trade I continue to try on. It’s going to break higher and run on of these days. So I’ll keep trying with appropriate sized positions until it does. Given today’s monster green bar, if we see any sort of follow thru, 100 should come quick.

Backtest Trade Idea:119.5ish 122c

BABA is on the verge of breaking higher over 120+ and it may do that tomorrow. In which case, a breakout trade should work for 25-30% of price runs into resistance at 121. I like to fight for more than that, so I’ll look to take a backtest trade and then hope for continuation over 121. If we gap over 120, I’ll pass on the ticker all together and look for something else. I typically avoid the Chinese stocks on gaps.

Trade ideas:

1. 262.5c>259.19 (over 260 works)

2. rejection of 260 take 257.5 puts only if market weak

You would think this is a growth stock the way it’s been moving lately. Weird times. I’m always hesitant to take slow blue chip type stocks on a breakout. For breakout trades to work on these tickers, usually, a catalyst is needed and/or lots of momentum and volume. But, the way the stock has been moving lately, it could be worth a small position.

I’m also willing to take this trade short. Dino, didn’t you say earlier not to look at short trades? Yes, yes I did. I’m a giant hypocrite. The only way I’m willing to take it short is if the market is showing broad based weakness or if it’s choppy and CAT is showing lots of relative weakness. Again, going back to historical norms, a short trade off a double top on a slow moving stock is a nice setup and that’s what we’re looking at here. Short or long on CAT the position will most likely be small.

Trade Idea: 105c>102

Crowdstrike had a really nice reversal off pretty serious lows today. Price came right up to a minor resistance area right were some gaps are at the close. With premiums being cheap, a 1 point move should give 40% but I think it has room to run up to high 103 or low 104 if it does get thru 102 cleanly. A 2 point move would probably give us just under 100% on the options trade.

Rejection Trade Idea: 182.5 take 180p

(Take this or XOM, not both. And only take if crude/energy weak)

Pretty simple trade. Going back to what I mentioned about CAT, big slow blue chip approaching a string resistance level, chances are it gets rejected without momentum. In Chevron’s case, that momentum is the crude oil market. What I mean by that is if the stock gets pulled up higher because the equities market is strong, but the crude oil and energy markets are weak, it’s ripe for a reversal.

Further, you can give yourself a tight stop on this one. If you see it get thru 182.75 to 183, the trade was wrong and you exit. No big deal. Push it aside and go find another trade.

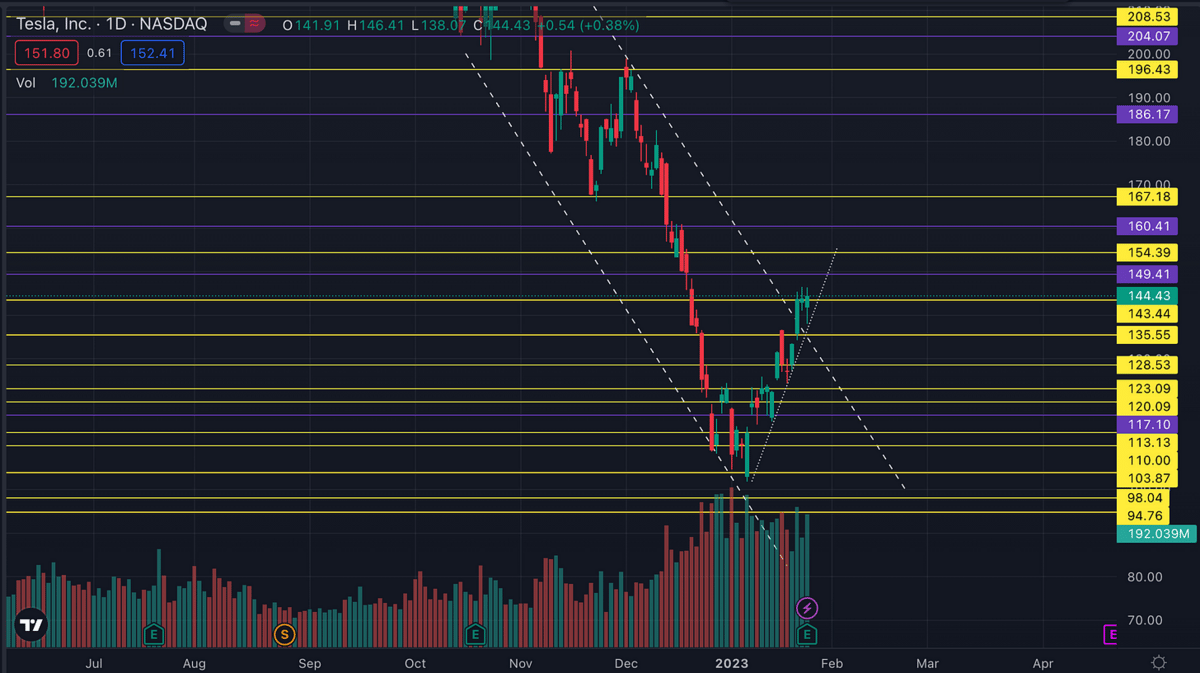

On Watch: 140 response on backtest

Or 145 on breakout

I’m not quite ready for a trade tomorrow. I’ve been trading this one a lot on this big run up but we’ve come to a point where I’d like to see some construction or keep following thru.

On the construction side, that means seeing 140 hold up similar to how it did today. It will show there’s strength in that area and buyers are looking to get in.

On the continuation side above 145, does it break higher and run? Unless we get a massive rally tomorrow, moving 3.5 points plus another point or two to make the options trade work, feels a bit extended. Hence “on watch”.

Trade idea: 200c>194 or

192.5c on 188+ backtest

Two pretty simple ideas for trades. First one, we break above this local resistance that’s developed at 194 the past few days and run higher up to 197 then 200. I’d be fine with 2.5-3 point over 194. That trade should see about a 60-70% gain. If we get up to 200, that would be killer giving 130-150%.

The second idea is more or less the same as today, backtest support around 188, buy the dip and wait for a reversal. Nvidia did drop under 186 today on the weakness so I would avoid this trade in a choppy or down trending market if that happens tomorrow.

Trade Idea: 100c>97 (over 97.5 also works)

PDD has a pretty nice bull flag formed up and consolidated nicely the past few weeks. I’d be willing to take this as a breakout type trade as high as 97.5, above that I won’t chase. This is typically a slow mover but with Chinese stocks on the move the past few months, if volume comes in, we could easily see a pop to 100. 1 point should see the options trade pick up 40-50%, while a move to 100 should see 125% plus.

I may size this trade as one that can go to zero. I typically do that on lower priced options. They can be hard to exit at a reasonable price without getting totally smoked because of liquidity. In other words, if I’m going to lose $0.0.5-0.10 or maybe 15% just on illiquidity and slippage, just hold the position.

On Watch: 45.5ish backtest

I tried to grab Shopify today but got greedy on the entry and missed it. So I may be sitting this run out. I want to try to get in on a backtest, so if price comes back down to the 45.5 area I may look to take a trade. But, a lot will depend on how price got there, how the relative strength is, and how the rest of the market is fairing. Getting in after a big run on a backtest, sometimes isn’t black and white. Definitely not a newbie trade as there are a lot of factors to weigh before taking it.

On Watch: 147 backtest

Tesla looks like it’s going to gap up at the open after their Earnings report. A lot of times when there’s a very positive after hours reaction to an earnings report, we see a gap up on at the open, followed by an immediate sell off the first few minutes. Think about this rationally. Why does this happen? If you got lucky on an earnings trade and it gapped up huge the next morning, would your take some profit off the table? Well that’s what most people are doing at the open. So that profit taking gives a buying opportunity as well. But again, not a trade for newbies. You will have to be quick and just because I say I like the 147 level,doesn’t mean it stops there. Who knows, it could give back the whole gap up move. I’ve seen it happen plenty of times.

Below I also gave the weekly chart to give you a better idea of the levels I’m watching. Since Tesla had this big retrace, many of these levels haven’t been seen or tested in quite some time.

Weekly Chart:

Rejection Trade Idea: 114+ take 113p

(Take this or CVX, not both. and only take of crude/energy weak)

Exxon is getting back up to these multi year high major resistance area. It’s had lots and lots of trouble getting thru 114 cleanly. That is why I like it for a short trade. If the market is slow and the crude market is showing weakness, I fully expect price to fail at 114-114.5ish. I think it would take a lot to clear those levels such as some unexpected catalyst right as price was approaching 114. Similar to the CVX trade, the upper level is pretty clear cut, so easy to put a stop in just above 114.5.