TLDR Friday Trigger List:

Today’s boring results on the gap up. Just because we get a big gap up or gap down doesn’t mean you have to trade. My type od trading doesn’t typically suit gap days very well. Reason being, I like to catch runners. If the big run has already happened premarket, we need a massive move to make most trades work.

#ES Mini Futures

Upside: 4080, 4110, **4180**,4215

Downside: 4050, 4020*, 4000,3980-3975, 3950, 3915*, 3860, 3810, 3775*

With yesterday’s big reversal and today’s gap up with a close near the highs, imho, the bear market is over and we are heading higher. Of course, I could very easily be wrong as soon as tomorrow, if we reject off 4180 and reverse. I don’t see it happening but ya never know.

4180 is the next big level to watch. If we clear that area with ease, the move should rocket higher. First things first, we need thru 4100.

It is still possible we chop sideways over the long term. This run up and over the major downward trendline is still young. Only time will give us a better idea of what the next possibilities are for the broader markets is the near term.

My bias will stay to the long side until we get a major reversal or closes back underneath the downward trendline.

Upside: 407, 411*, 417, 420

Downside: 403, 400-399*, 397, 393, 390*,387*,383*, 378, 374*,370

SPY is a bit more in no man’s land after today’s close. Barring anything weird happening overnight, 407 should get tested tomorrow based on the strong close today. 411ish is equivalent to the 4180 on #ES. If you like as your market mover, watch that level for a reaction and how it fails or how price gets thru.

Upside: 297*, 302, 307, 310

Downside: 293, 290, 288,285*, 275*, 270*, 266, 260*, 279-280

QQQ closed right at a major level in 293. The open should be key tomorrow in seeing if we head higher and test 296-297 with strength. The way todays tech action went, buyers were able to overcome any downward pressure. That bodes well for tomorrow and possibly early next week.

Trade Idea: 146c>144.25 (can also wait for 145)

145 is a major support/resistance area but price has shown so much strength it could very easily pop over. I like this trade for a Friday trade because it won’t take much movement to make a nice profit. Taking it over today’s high of day is a bit early, but getting in 0.75 of a point before a round number 145 retest could already give enough profit to take some off the table of price stalls out at 145.

I like to look for simple easy ideas like this. I ask myself, if it breaks over X support level and makes it so many points, will it give me enough profit to take some off the table. That simple. That is why many times you won’t see me trading TSLA or other high IV stocks early in the week. It just takes too much movement to get a nice gain.

Trade Idea: 111c>110

Another one that’s approaching a major area around 110. AirBnB had a little trouble around 105 but reversed back higher hard with the rest of the market on Wednesday. This trade is a similar idea to AAPL, however, I don’t want to take this one early for two reasons. One, it isn’t as liquid as Apple so if volume dries up, price movement may dry up as well and, two, there’s plenty of low and high candle points in the last year between 109-110 to cause issues getting up to and over 110.

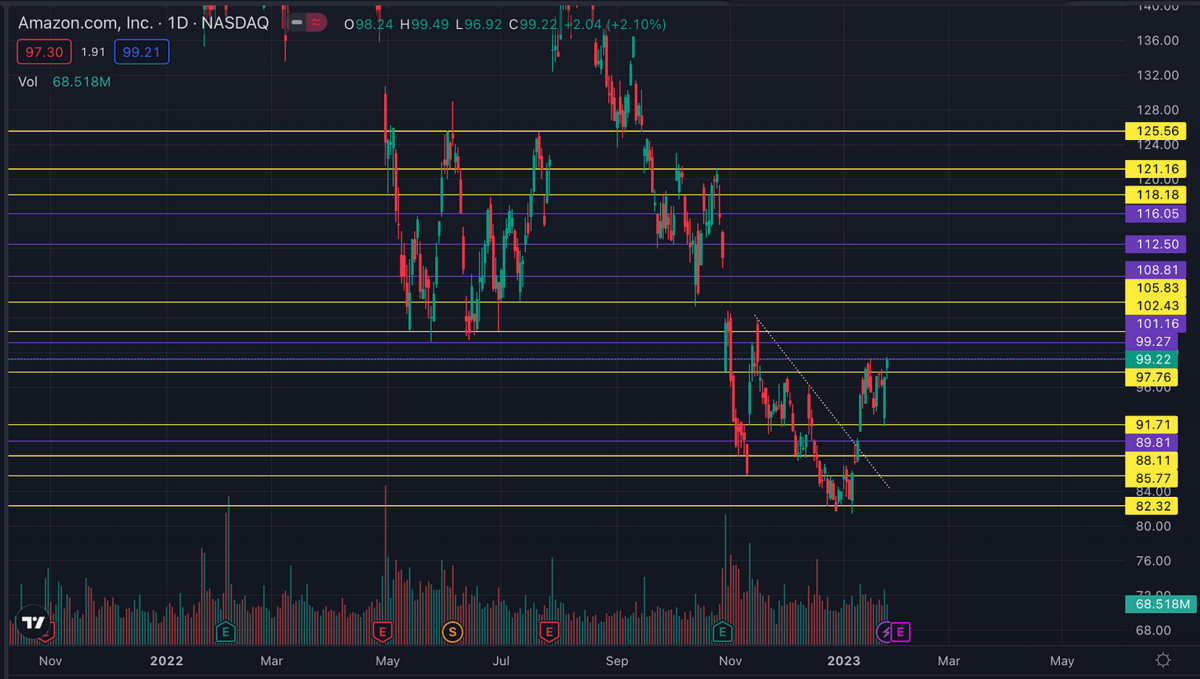

Trade Idea: 100c>99 or 101c>100 on a gap but be quicker to take profits

Amazon closed right above where I was hoping the trade would trigger for tomorrow. I still like the trade of we open just under 99 or backtest 99 right at the open. If we get a gap up day, I’ll watch to see the reaction at the big round 100 mark. If the market looks strong at the same time Amazon looks ready to clear 100, I’ll take the trade.

Trade Idea: 140c>139

Braidu has formed up this bull flag since the start of January with the top being right at 139. Although the support/resistance level is more like 140, again, cheap premiums like AAPL ABNB and AMZN can make this trade work with a small move.

Starting to notice a trend here?

Find stocks that can make good money with not much movement, BUT are capable of making big moves. What I mean by that, something like a etc may be cheap and only need 1-3 points to make a nice profit, however, how often do you see the bigger runs of 4%. Almost never.

On Watch over 55

55 is about the spot where the top of this latest bull flag has formed. I’m not totally convinced we get a clean break due to the overhead resistance as well as the ever volatile crypto market. Further, COIN had a pretty weak close and we will need a pretty good sized run to clear 55. It can definitely be done, but, I want a better idea of what is going on in both the equities market and crypto market before jumping in.

On Watch over 187.5-188

Chevron had a major gap n go you don’t see very often in oil stocks. It also decided to run the last 10 minutes into the close which caused me to double think about a trade for tomorrow above 187.5.

Big gaps on oil/energy stocks, I’m a bit leery of. We could very well break higher tomorrow, but, similar to Coinbase and the crypto market, I want to see if the energies market has legs to keep pulling the oil stocks higher.

Trade Idea: 357.5c>355

Goldman has continued to hold up over 340. However now that it’s had a pretty good run, is it going to run out of steam around some of these upcoming resistance areas? I don’t want to worry about it. So find a way to get 2 points or so and make the trade work. That’s what I think can happen over 355 on this one. Break over a resistance area, grab 2-3 points, and hopefully, the options trade gives 75-100% profits.

Backtest Trade Idea: 145 holds take 146c or 147c depending on the time of day

I totally blew this one today. Missed the move over 145 and it ran 2+ points for a nice profit. For tomorrow, I don’t want to chase it too much. I’d prefer to enter on a backtest of the 145+ local breakout area and try a pick off an easy point or two. As the end of day approaches I would move more towards taking the 146 calls since time value will be next to nothing 2 plus strikes out towards the end of the day.

Trade Idea: 375c>369

Netflix has tried to get over 369-370 area the last two days. It’s somewhat of a major support/resistance area dating back to the beginning of last year. I think if it can clear 369 on some sort of strength, whether that be relative strength, or broader strength in the market, we should see a 5-7 point run.

Netflix can be finicky. Today for example, it was definitely a laggard compared to other big tech. You expected the upward run to continue over 370, but nothing ever got going. In words, be carful jumping in if there isn’t some sort of strength being shown on NFLX itself.

Trade Idea: 155c>153

Snowflake showed great strength the last two days. First, holding up by bouncing hard off the 135 area support. And then second, getting back over the downward trendline with strength and right back to testing the 153 area from just 2 days ago. This 153 area is fairly important as there have been a few reversals/bounces in this area going back to May of 2022.

I don’t think it will take much for this to run given how strong upward price movement was the past two days. And no, I don’t feel like I’m hopping on the train late. It still has plenty of room to run higher.

Trade Idea: 165c>161.5

To put simply, get over todays high of day, take a conservative call play and hope it runs 6-7 points. I was really surprised we didn’t get a backtest of 150ish today. That tells me there is s lot of demand for buying. Whether it’s short sellers covering, more buyers buying, or just not enough inventory to accomplish the first two, frankly, it doesn’t matter.

There was plenty of strength and 161.5 also coincides with a resistance level from early to mid December. So, if we can clear this level, I think we see a nice run.

Trade Idea: 125c>124.4

Once again, get a point or so over a high of day or local support area and we should see a 40-50% gain on the options trade. That’s the short of it.

More importantly for a run we need to see if clear 126. But say we get to 126, you should be able to take profits at a 50-60% gain and then if we get a run, it should double pretty quickly over 126. Those are the trades I like the best. Get some profit early, clear a support/resistance level, turn into a 2-3x. Easy Peasy.