TLDR: Thursday 1/15/2026 Watchlist is at the bottom of the post.

No triggers for today. The Watchlist levels kept us out of trades that would have been losers. This is why support/resistance levels are so important

S&P 500 / $ES_F ( 0.0% )

Bullish: Over 7030ish (or all time highs) with volume

Support: 6800-6859

From a technical standpoint, the Iran conflict could cause some issues if price fall out of this rising wedge. This would be a more short term bearish signal. However, we are still in a consolidation phase. If 6800 can hold up as support, more consolidation could be in store. If price falls below 6800 with momentum and Iran escalation, I will flip to a more bearish stance. Right now, I’m sitting on my hands to see how these events play out and remain neutral.

Bullish Upside: Over 629 then 637

Downside Support: 613ish in consolidation conditions, 600 if the market has a major drop due to Iran.

I still think the Nasdaq has to lead any broader market push high with any sort of volume and momentum. Iran may have other plans. Watch how price handles the 613 level. Similar to $SPX, price is starting to fall out of this flag / wedge that’s formed up at ath’s. Below that 600 could come into play with any major downward momentum. If 613 fails, I will be more bearish leaning but still neutral. Below 600, we have to wait and see how price develops over the coming days.

$AMD ( ▼ 3.41% ) >225 230c

Still looking good. We stayed out of this trade today by waiting for the 225 level to clear. 225 is the key area. For tomorrow, 225 needs to clear with some market momentum. Even if it clears 225, be aware of how the broader market is acting. If everything is down because of Iran, this may be a trade to avoid.

$ASTS ( ▲ 4.13% ) >95 98c

Break above this small consolidation with a push towards all time highs could see a nice break if market conditions line up. I will still take this trade if the individual ticker shows good strength as long as the market isn’t tanking

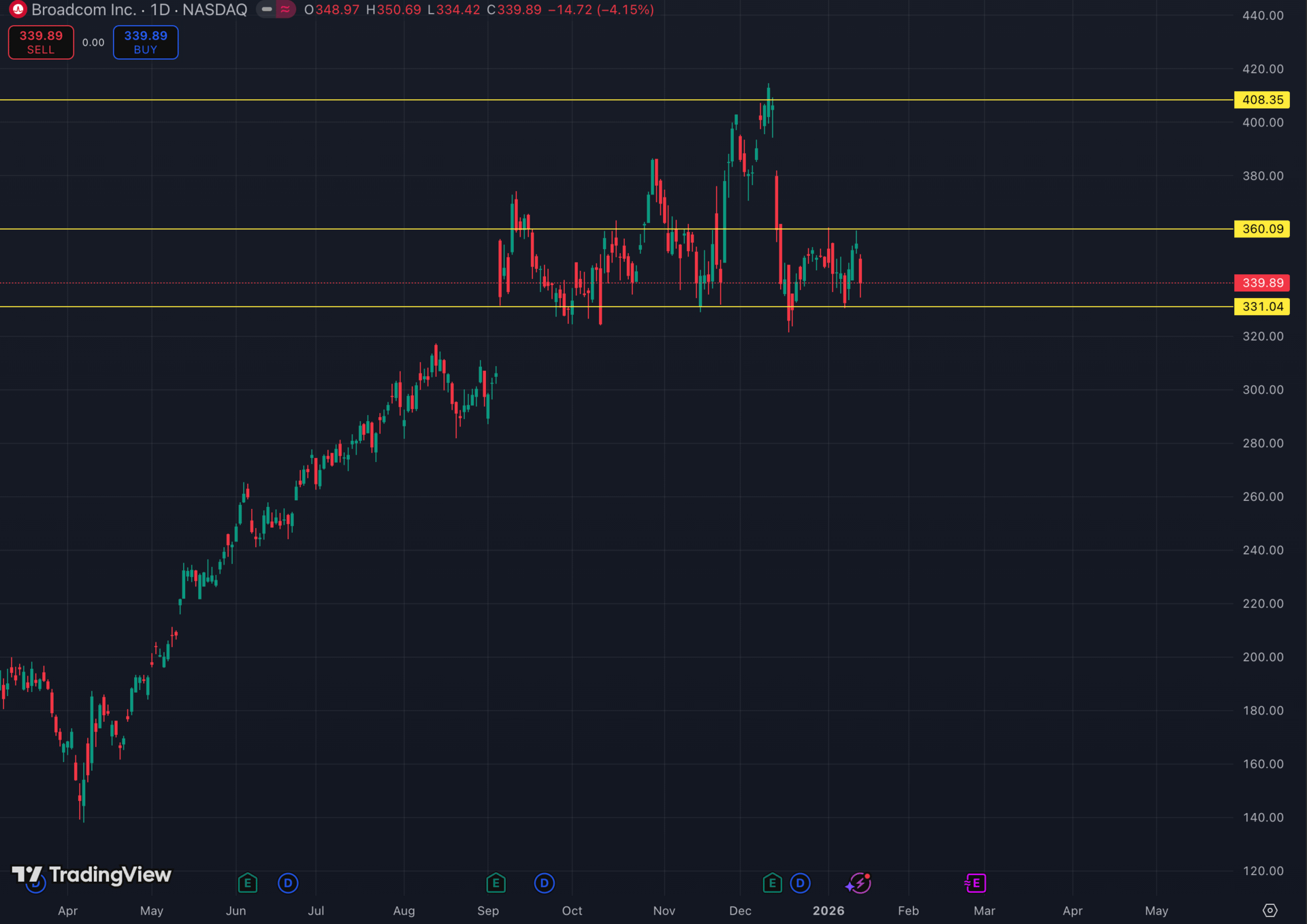

$AVGO ( ▼ 3.19% ) <330 325p

If tech, chips, and the broader markets are all super weak, this could be a good short. Look for a break below 330 for a drop down to 320-325 area. We could see a bigger drop on this one to fill the gap into the 315-318 area

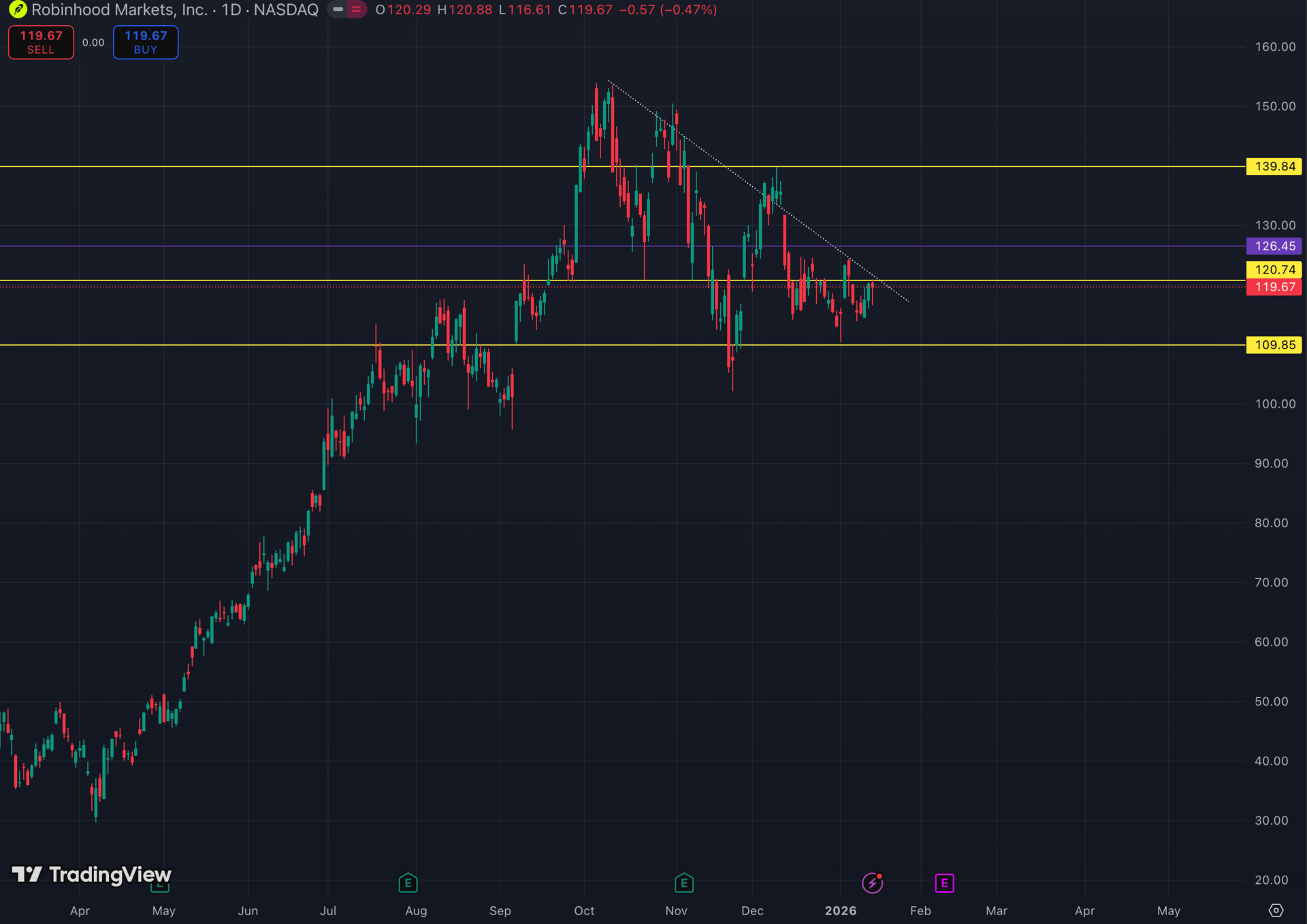

$HOOD ( ▲ 2.48% ) >121 123c

Still waiting for this one to break out above the 121 area. Even if this trade triggers tomorrow, we need to see strength or at least consolidation in the broader markets.

On Watch:

$RKLB ( ▲ 3.49% ) 88-89 back test. 92c only if market looks positive

Thursday January 15, 2026 Watchlist:

$AMD>225 230c

$ASTS>95 98c

$AVGO< 330 325p

$HOOD>121 123c

On Watch:

$CRWV>92

$RKLB 88-89 back test. 92c only if market looks positive