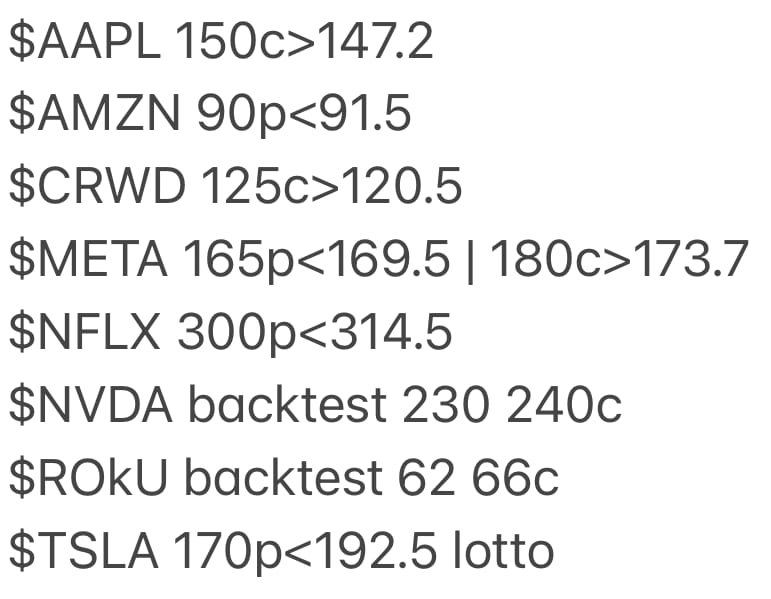

TLDR: Monday’s Watchlist is at the bottom of the post. I will update the list tomorrow before the open if anything odd happens overnight.

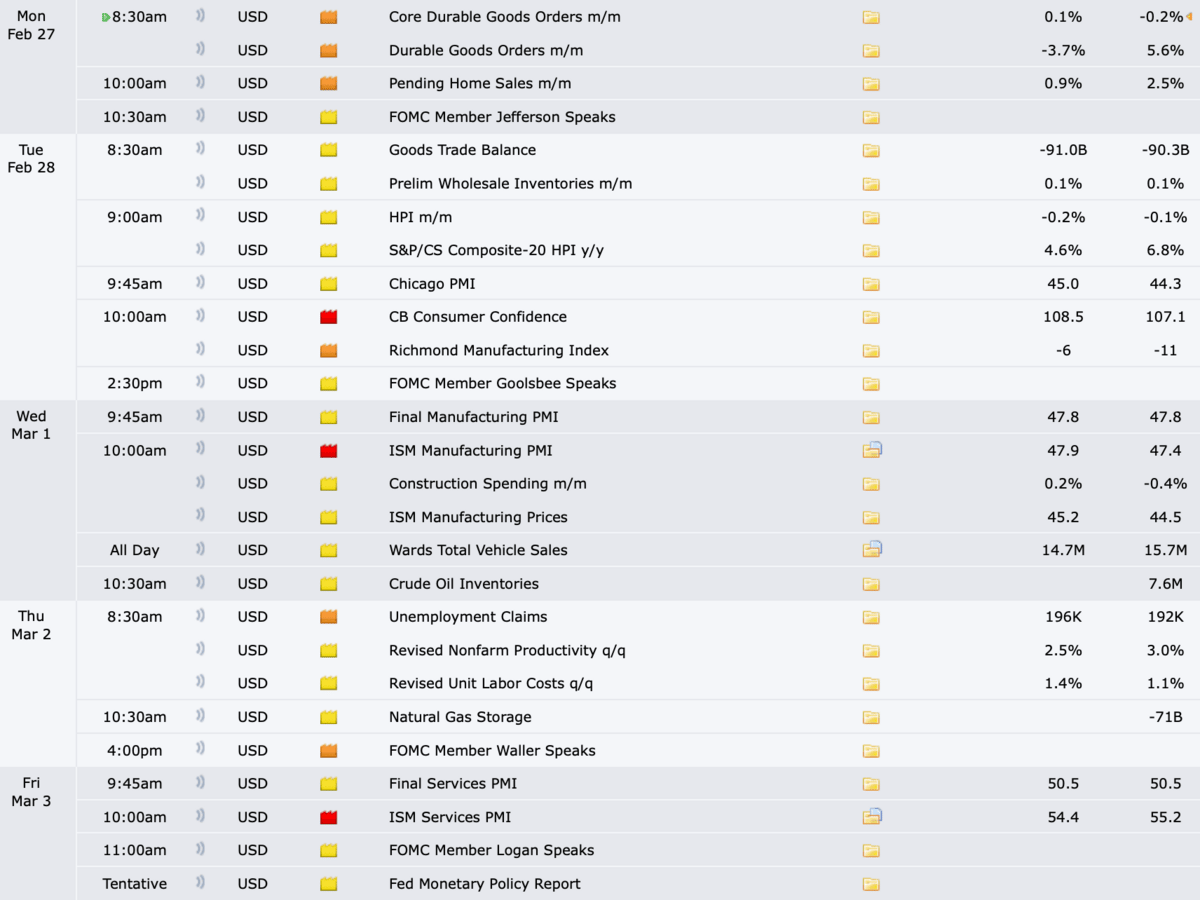

News Events Releases:

(Courtesy of Forex Factory)

Nothing huge jumps out for news releases. A few members of the Fed speak on various days. Be aware of the times they speak and your risk around those times. I don’t expect anything huge, but you never know what they may say.

Watch the consumer confidence numbers and the Manufacturing numbers as well. These number releases give macro economists a picture of how the current economic environment appears. Any surprises to the upside or downside and we may see another data point for the Fed to shift policy.

The housing data could be another important data point. Since housing is one of the main drivers of the US economy, any big surprises could see the markets move or aid in a shift of Fed policy.

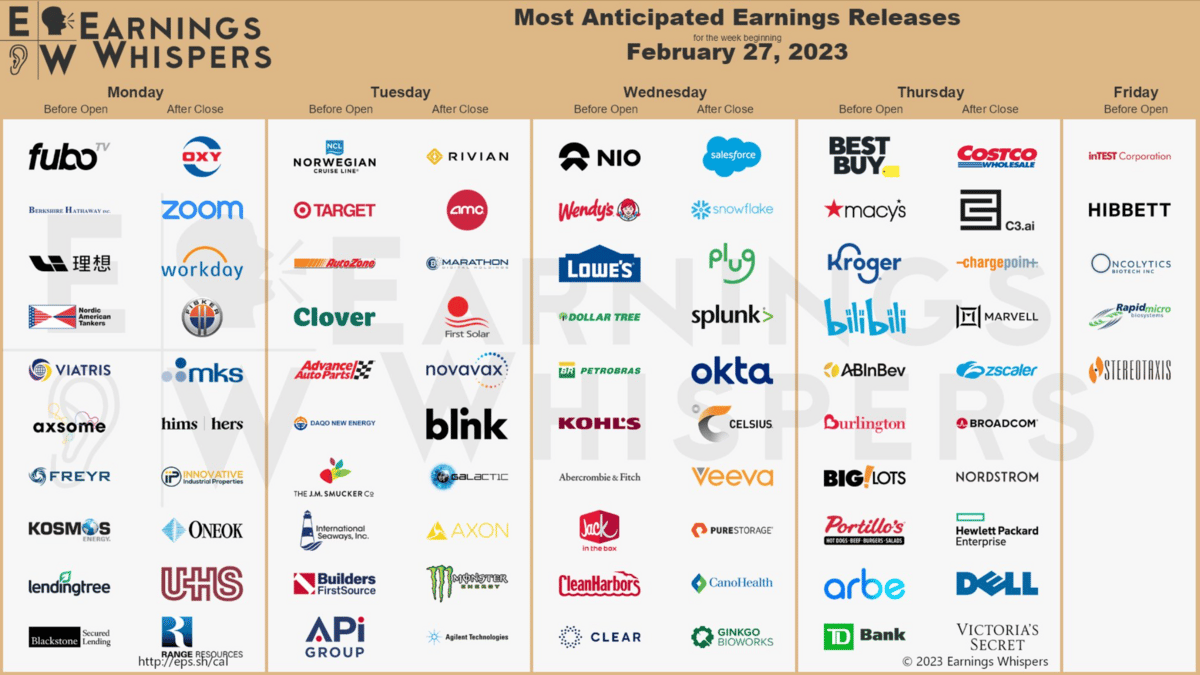

Earnings Releases:

(Courtesy of Earnings Whisper)

No major market movers report their earnings this week. Earnings releases from the big retailers occur throughout the week. While no single release will make huge market movement, if they collectively are very positive or very negative that could change market dynamics. With the consumer confidence numbers plus a variety of retailer stocks, a clear picture should form on the shape of the economy.

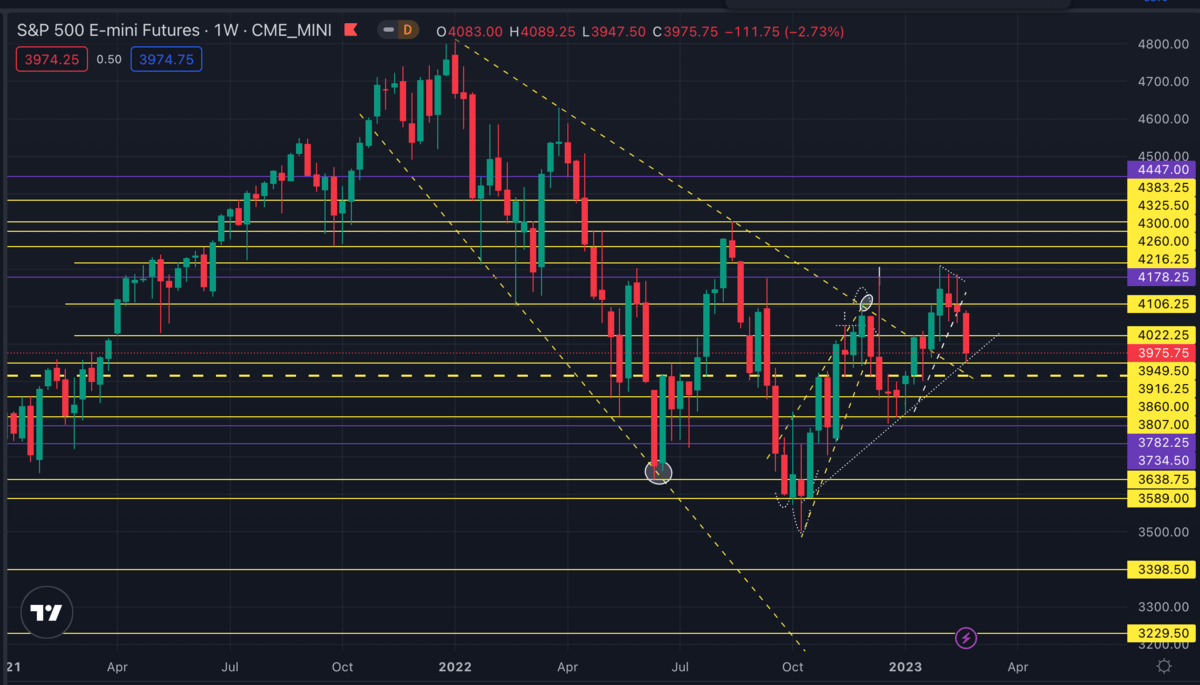

#ES_F S&P500 E-Mini Futures

Upside: 4000, 4020, 4050, 4080, 4100-4125, 4180, 4215, 4260, 4300

Downside: 3980-3975, 3950, 3915

We felt pain in last week’ eths price movement. Just nothing moved with any sort of certainty. While trends developed, they were slow, grindy type movement. Whenever this type of market develops, it is difficult for us day traders to find clean trades. The only way to have success in these types of markets is patience. It can be unbelievably frustrating to watch big moves and not make any money on the move. But, these are the current market conditions.

Going into this week, many traders are calling for doom and gloom. I’m not so sure. #ES_F has develop plenty of support around the current price level. Further, there is still wiggle room down to 3900-3915 to keep the bull uptrend intact. Technically, we’ve lost the higher highs and higher lows on the daily chart but, the weekly chart (chart below) is still intact. If we lose 3900 with momentum, I will shift to a more bearish stance. For now, I remain neutral. I expect much more of what we saw last week into this week. If we see a bunch of gap and/or grind type movement, work on your emotions and patience. That is the best time to learn how to sit on your hands and not get sucked into bad market conditions.

With the choppy price movement, we need a catalyst to push the markets in one direction or the other. It would not surprise me to see price fall a little below 3900 and bounce back, trapping a lot of traders on both sides. A drop to around 3900 would also backtest the longer term downtrend line that formed since the all time highs.

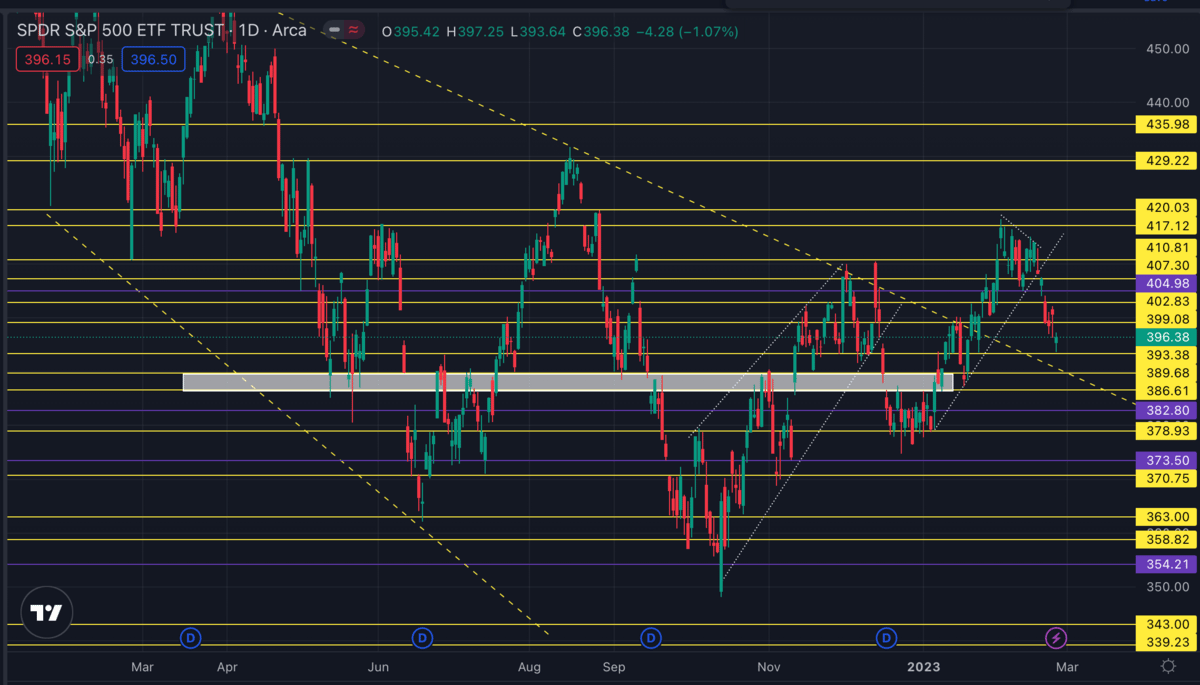

$SPY

Upside: 397, 399-400, 403, 407,410-411, 417, 420

Downside: 397, 393, 390, 387

In a few of last week’s newsletters, I mentioned SPY is more or less following the S&P Futures chart. There is not a ton to add. If you like to trade SPY 0dte, understand the current environment. With slow grind, choppy movement, the 0dte options will lose premium quick as the day progresses. Always understand your risk. Now is not the time to full port or take tons of risk.

I don’t love where SPY is sitting for a trade. You could think about taking a backtest trade off 390 for a lotto type trade. Other than that, I want to get thru some of Monday to see what happens across the broader market to see if we go anywhere or just chop.

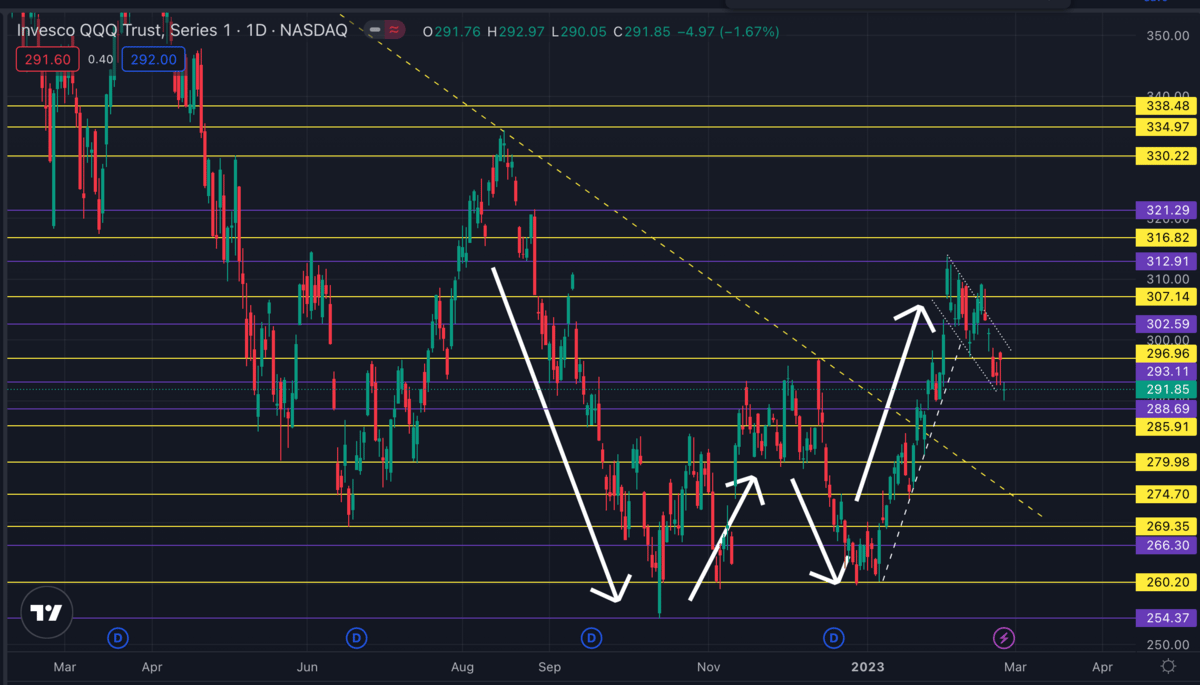

$QQQ

Upside: 293, 297, 302-303, 307, 310, 313

Downside: 289-290, 285-286, 280

QQQ and the NASDAQ still look in better shape than the S&P500. We have this nice double bottom, “W” type, bottoming formation. Similar to SPY, we lost the higher highs and higher lows on the daily, but the weekly still looks good for the higher high and higher low formation.

Where do we go from here? It’s tough to say. Will the NASDAQ be the driver or the passenger for the markets in the next few weeks? Who knows. If we see some of the growth stocks start ripping similarly to the start of the year, those could pull the broader market higher. Growth stocks typically lead rebounds and follow pullbacks.

For this week, I would like to see price hold above the current levels which are the middle of the “W”. If we fall, 285-286 is good support. Below that, 279-280 is the last stop before things could get ugly and everyone shifts to a bearish bias.

For tomorrow’s QQQ trades, I don’t see a lot out there. If you try to go long over 292.5, you could see resistance at 293.0-293.5. Unless you scalping, I fear it may be slow going tomorrow.

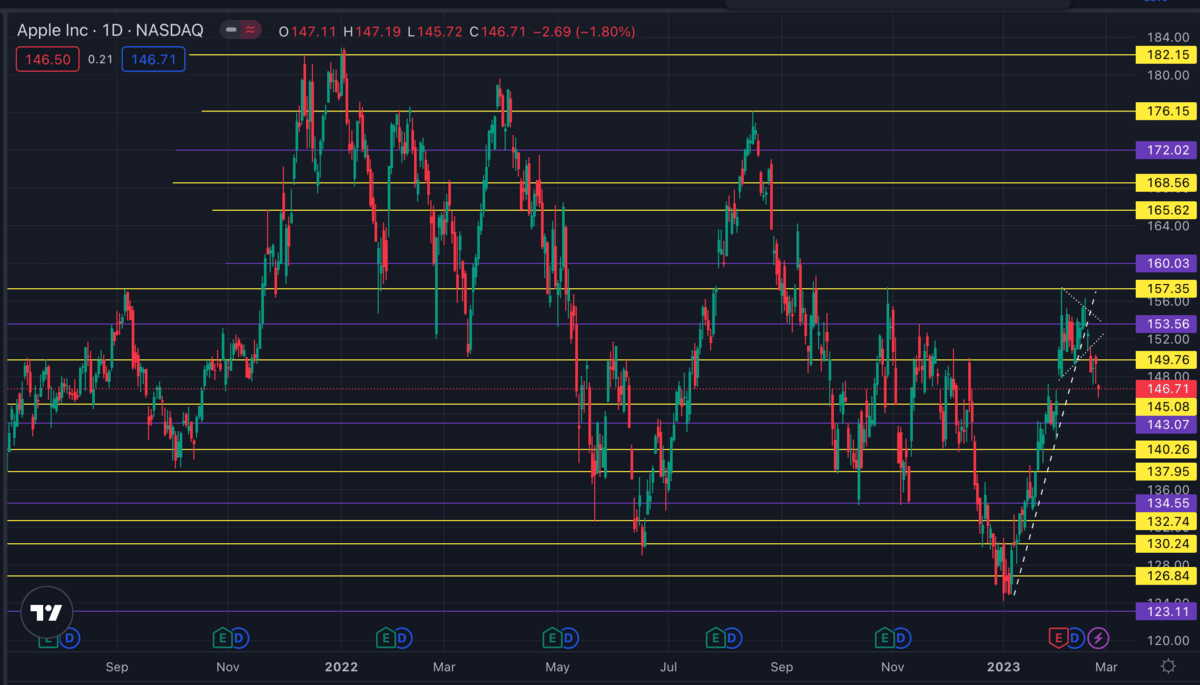

$AAPL

Trade Idea: 150c>147.2 small sized position

This trade idea is a bit risky given Apple’s downward move after losing the bull pennant and steep upward trendline. But, Apple’s price is bouncing off a choppy area as well as filling the post earnings gap. Its price could see a reversal to try and test 150 again. If you take this position, I would not give it too much rope on the stop. A good stop could be Friday’s close around 146.7. On the upside, if we don’t see strong movement, I will close the trade out even if things look ok. The reason is chop. I don’t want a green trade to turn red simply due to chop and options losing premium. If it runs, it runs. Get over it and move on to the next trade.

$AMZN

Trade Idea: 90p<91.5

Amazon’s trade idea is relatively simple. $AMZN has seen a big pullback after the big run up from the start of the year thru their earnings report. The formation is somewhat of a head and shoulders, but regardless of the formation, it appears very toppy. A break below 91.5 is around where the current formation has bottomed. There is some small support around there, but with the big topping formation, it’s worth taking a shot to the short side.

To the upside, I don’t see a setup worth taking. We need to wait for some more construction to see if something will set up for upward movement.

$CRWD

Trade Idea: 125c>120.5

Crowdstrike has consolidated nicely since the start of February. It also held the uptrend line and hasn’t seen huge movements down with the rest of the market. aka showing relative strength. I like this one over 120.5. But, I want the move to come not to away from 120ish. In other words, if the market is slow and CRWD is around say 115 and gets a big pop up to 120, I would not want to take that trade in a slow market. Ideally, we see around 118-119 in the next day or two, and then get a push over 120.

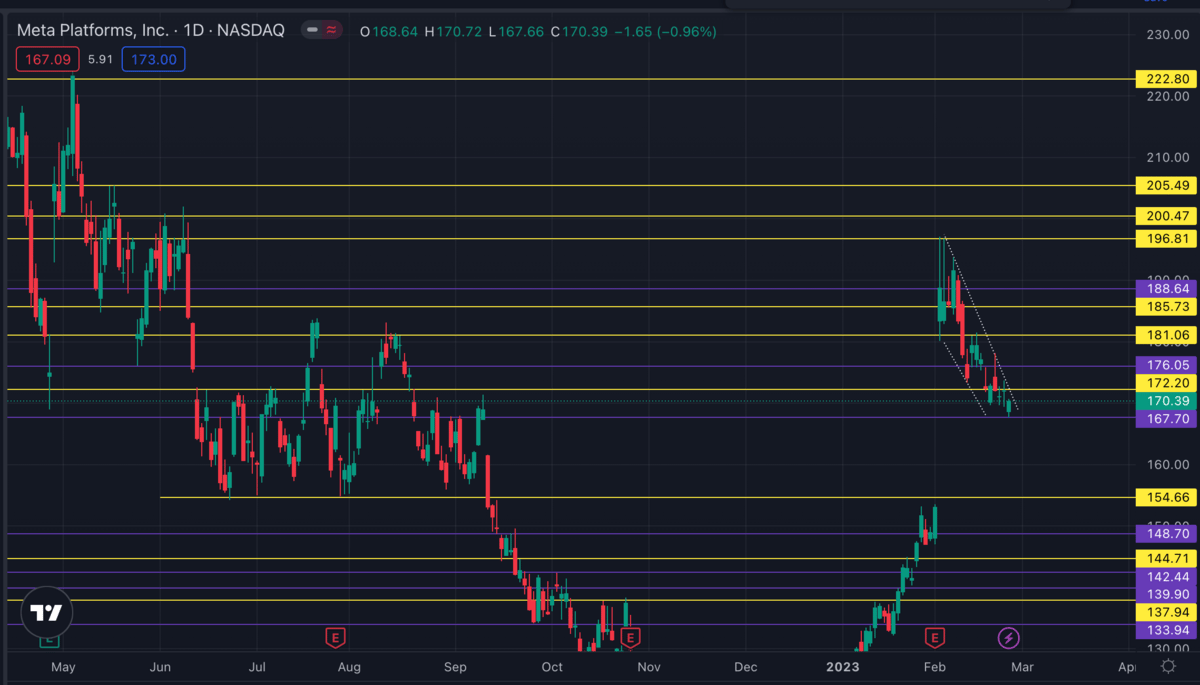

$META

Upside Trade Idea: 180c>173.7

Downside Trade Idea: 165p<169.5

Meta is still in a descending wedge falling the early February earnings report. I’ve mentioned the gap below numerous times lately. Filling the gap will not be black and white due to the big chop zone from June 2022-September 2022. We could see any number of things happen off the chop as well as breaking under or over the descending wedge. To keep it simple, I will follow what the market is doing. In other words, if the market is weak and it looks like $META will break below 170, I will look at puts. If there is strength in tech and big caps, I will look at calls toward 174.

If you are unsure on a trade or setup, I like to keep things as simple as possible. If I still can't create a clear picture, I sit the trade out.

$NFLX

Trade Idea: 300p<314.5

Netflix is turning into a hot mess. What we thought would be a major run higher is running out of steam fast. The trend is, without a doubt, down. I’m going to follow the trend and keep it simple. The only hiccup will be the ugly looking upward trendline. Is the trendline clean enough to act as support? I’m not sure. But, in my mind, it’s worth taking a shot lower. There is enough of a price level around 315 from the past two trading days, plus going back to December, and then February. Further, the post earnings action looks to be an ugly looking double/triple top or maybe a rounded top. All of the “checklist” items mentioned make it a good short candidate.

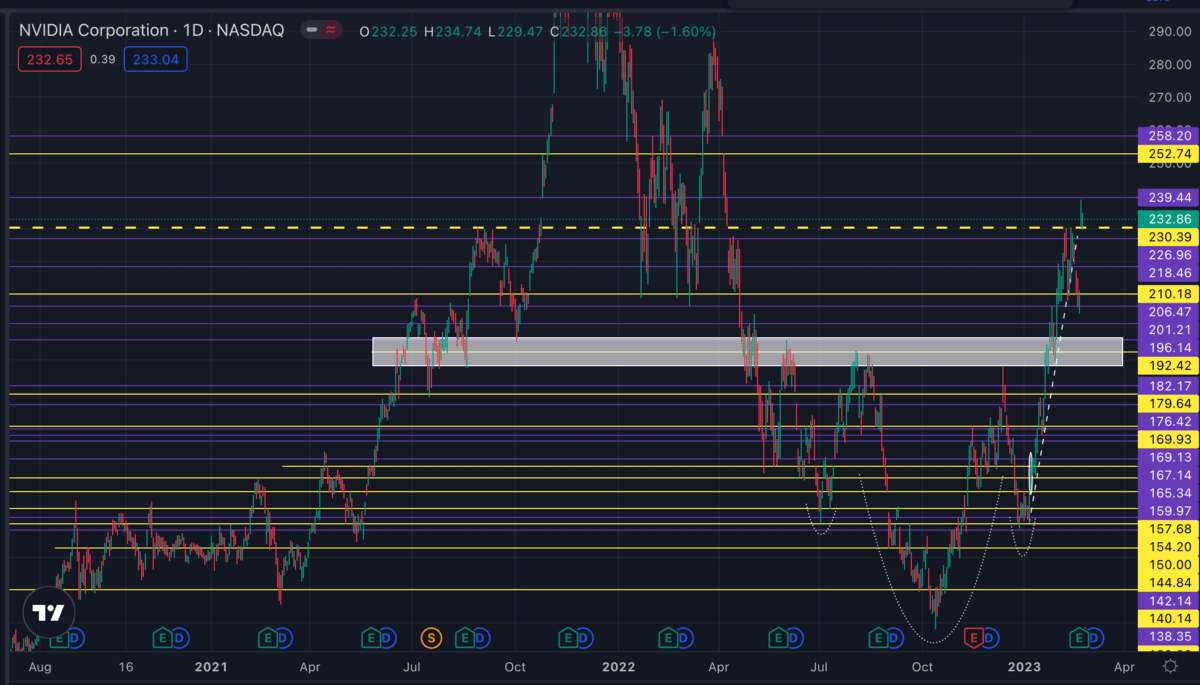

$NVDA

Backtest Trade Idea: 230 holds take 240 calls

Or 220p<230 ONLY IN A WEAK MARKET

Dino, I’m so confused…you’re saying go short and long at the same spot. Yes, yes I am and, here is the reason. If you look below at a zoomed out chart of the daily, you will see 227-230 is a major support area. While the post earnings gap is massive and many people will be looking too short into that gap, I could easily see price bounce out of it rather easy.

How to decide whether to go short or long? Again, follow the broader market, tech, or the semi sector. If the whole tech market is weak and Nvidia’s price is approaching 230, I will look to short. But there is a caveat. There needs to be enough room on the downside before a major support area on the NASDAQ, the S&P 500, or both. For a numbered example:

If $QQQ is lingering but weak around 289 and $NVDA moves under 230, I would probably avoid the trade. On the other hand, if $QQQ’s price moves right under 289 without much a test and 230 follows on $NVDA, that will be a better opportunity to short.

If the market is choppy or showing strength, I like the backtest trade for calls. This is the type of trade I may size the trade initially very small and look to add if price goes against me under 230 with a slow market. Only in a slow market. The reason to think about an add is simple. At 227, there is good support also. If you are new, understanding how to add can be hard. Another option could be to size small and keep a tight stop. If price moves under 230, stop yourself out and try again at a 227 backtest.

$ROKU

Backtest Trade Idea: 62 holds take 66 calls

62 is major support. The 62 level held on Friday and has shown plenty of flips of support and resistance over the past 6 months. I will avoid this trade in a weak or choppy market. Why avoid $ROKU but possibly take $NVDA with a choppy market?

This comes back to understanding a ticker’s nuances. Meaning $ROKU tends to move slowly and not very cleanly. On the flip side, $NVDA’s movement and levels are cleaner. For example, look at the upper left-hand corner of the $ROKU chart above. It’s a mess. Big bars. Green and red bars back and forth, back and forth. Etc.

$ROKU is on the watchlist as a backtrade idea due to the 62 level being clean. If it were backtesting say, 66, I would have reservations about using that price level as a possible backtest trade.

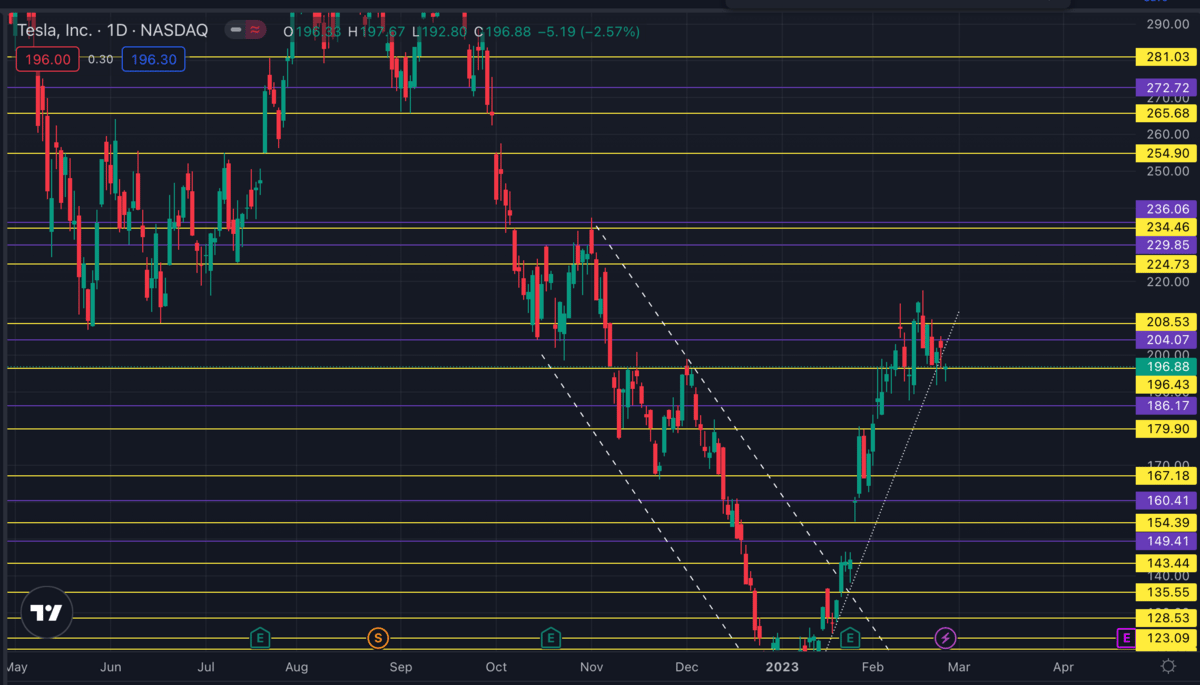

$TSLA

Trade Idea: 170p<192.5 lotto or wait for under 190 for a more conservative play

Tesla has begun to look toppy. Ideally, it chops between 195ish to 210 to create a base after this big move. However, if price decides to head lower 190-193 needs to hold up. The trade idea is a lotto because of the grey area of support in the 190-193 range. 5-6 points of movement should yield about 40-50% so it’s worth a lotto shot if it breaks below 190. The more conservative play would be to wait for a break below 190.

If the market is slow, I will not take the break below 193ish. Price will need momentum to get under 190 and in a choppy market, chances are slim it gains the steam it needs.

On the upside, I want to give it some more time Tesla may find a way to break higher over 200, but with lots topping going around 206-215, I prefer to wait for more construction.

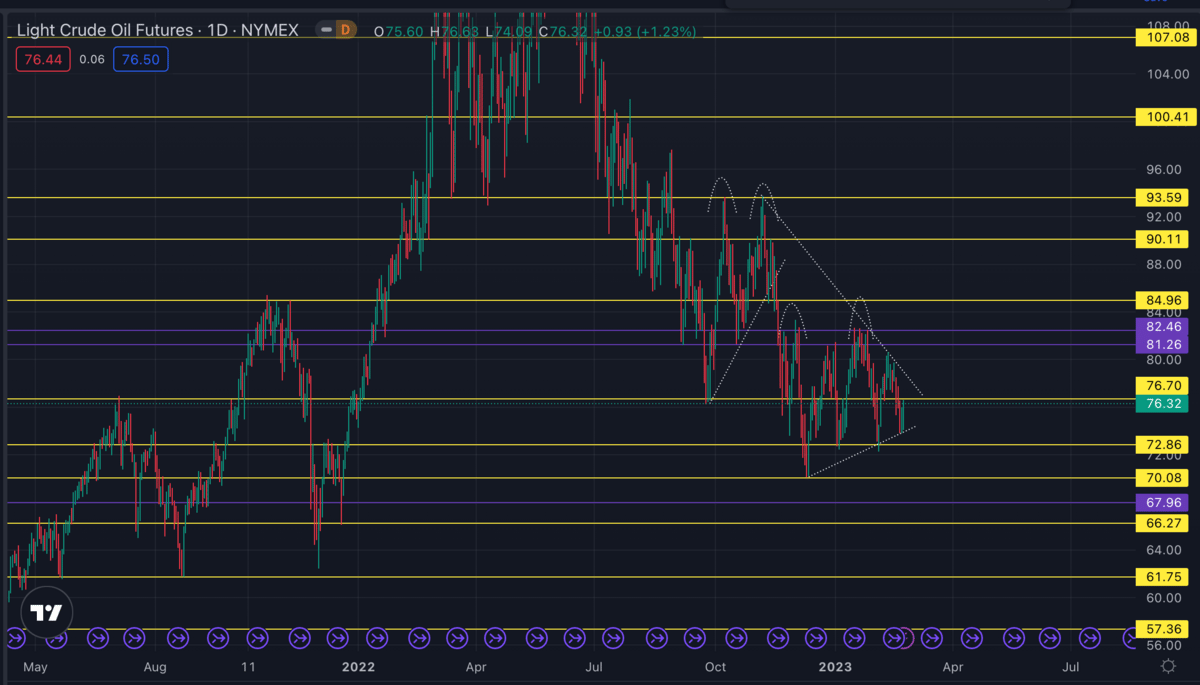

#CL_F Crude Oil Futures

Upside: 77, 81-82, 85, 90

Downside: 73, 70, 68, 66, 62

Light Crude Oil is still looking like it wants to head lower. Most recently, we had a quadruple rejection around 81-82 which also formed a head and shoulders pattern. Further, every major daily pop looks like it gets sold off and goes right back lower. This has formed a longer term bearish pennant. As the chart sits, I don’t see anything positive. The only way things start moving higher is with a break over 77 plus a strong move over the downward trendline. There is lots of resistance around all of these areas so it will take strength and momentum to get thru.

For the downside, watch the reaction around 72-73. If oil can’t hold up above those levels, 70 should come quick. Below 70, there is not much support until 66. I don’t expect a clean break below 70, but we never know, with all the geo political stuff going on with Russia and the Middle East.

$WTI

I removed most of the drawings off the chart to give you a cleaner view. Everything is more or less exactly the same as the futures chart. All the same ideas still apply to the upside and downside.

Chart Requests:

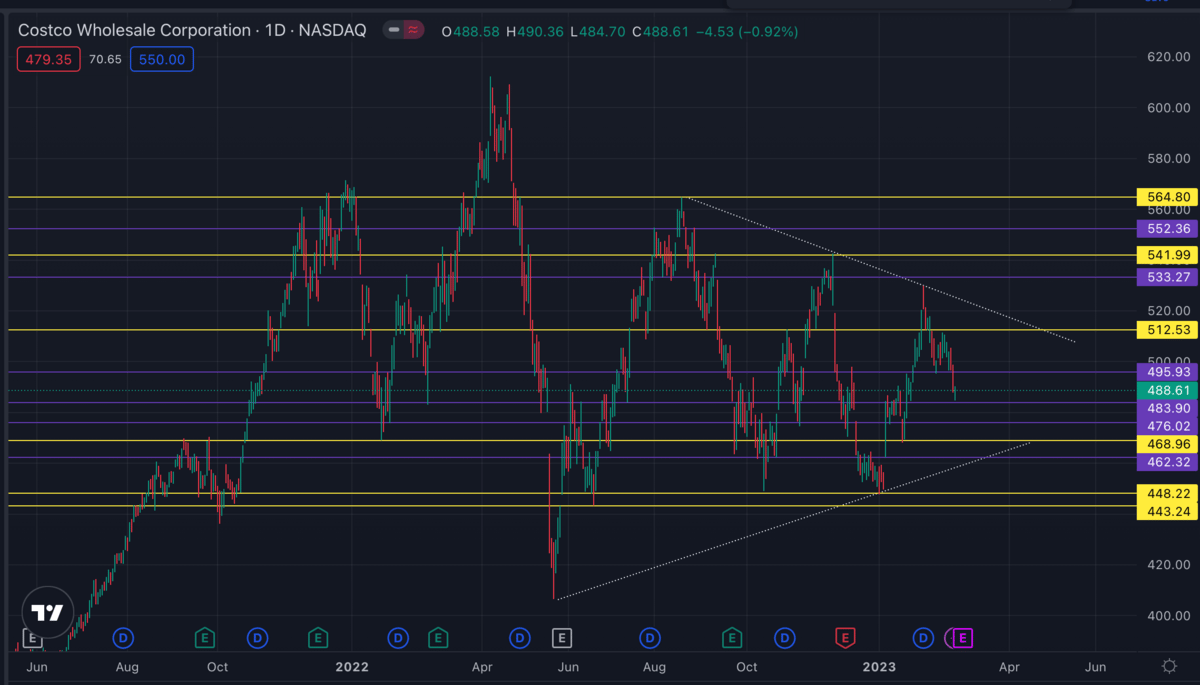

$COST

With earnings coming up later in the week, I don’t like anything about this chart. To the upside, 495 needs to clear but I could also see it rejected and reverse lower. The downside is a similar idea at 484-485. If it can’t break under that level, price could reverse back higher off the choppy support at 485.

Bigger picture I would wait to see what happens with earnings. There is about a 15 point move priced in post earnings report. If that’s the case and we get a ±15point move, Costco will still be in a choppy area. After the ER, the premiums will be out of the options’ prices plus we will know where the post ER support/resistance will wind up. At that point, we will have a better idea on how to play it.

$VOD

I don’t typically look at low priced sticks so this is my first time looking at Vodafone in a long time. With a price this low, I would only buy common stock and not options. With that said, overall everything looks negative. An “M”/double top formation is playing out and its price is resting at a support level. It looks like price wants to break under 11.60 area to retest the long downward trendline at around 11.00-11.25.

I would follow the sector and/or broader market st 11.60. Meaning if the market is weak, I would look to short below 11.60. If the market is strong, possibly look at a long lotto. The long side is more risky here. Below 11.60, I would wait to see what happens as price heads toward 11.00-11.25.

Monday’s Watchlist: