In our latest installment of Crude Oil checkups, let’s see how the market is looking. A few weeks ago in the last update, Sweet Baby Crude Oil Update, the major point of the letter was to look at:

“…we also have this ugly semi double top formation. The setup looks quite similar to back in October-November ‘22 time frame when we got a double top with a rising trend line failure. Will this repeat? A little too early to tell…However…There is a TON of supply/resistance at the 80-81 levels. If price rejects hard, we could easily come down and head for 61-62. Another option is price breaks over the 80 area and chops between 80-90.”

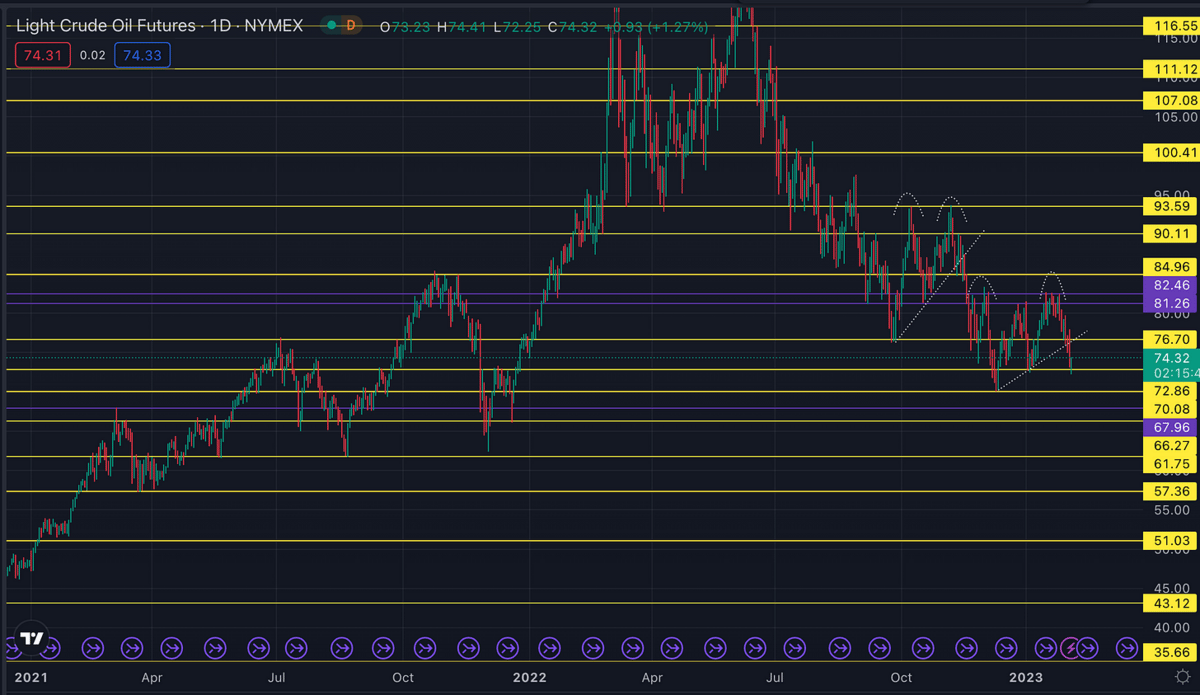

Along with this chart:

And below is the updated chart, notice anything familiar?

We have another double top with a rising trend line failure. While price didn’t “reject hard” off the 80-81 level, it looked very toppy at the time. Now the price of crude is lingering right at support in the 70-72 area.

What is going on?

From a technical perspective, the support and resistance levels are well defined. There isn’t enough buying demand to get over some of the tougher resistance levels. Further, anytime there is downward pressure, support levels are breached and price continues lower. This general trend has been going on since the middle of 2022.

From a fundamental level, another easy answer. The dollar is moving higher. More expensive dollar = cheaper oil (for the most part). The common sense answer on why this happens: Oil is priced in USD aka petrodollars. With a stronger dollar it takes fewer US dollars to buy a barrel of oil.

Looking back to last week, the dollar saw a false breakdown along with the surge in US equities.

Here is the $DXY Chart:

Where does Oil and the Dollar go from here?

For Oil, I think the answer is lower. Technically, oil has a lot of points to make the argument for further downside. I’ll be watching the 70 level to see if the price falls quickly thru that level. If that does happen, I expect to see a test of the 61-62 area relatively soon. I don’t think we will need months and months for that to setup.

The Dollar is more of a crap shoot. On the technical side, there is a fair amount of supply in the 104-105 area. There is a good chance we chop sideways in this area or reject and head back lower. For fundamentals…who knows. We have the FED, interest rates, debt ceiling, etc. The news events are never ending right now in the macro environment.

Some Tickers to Watch:

Chevron has come off the highs from 187-190. This is the second time it has tried to break out over the highs and failed. The price failed to break out over the rising wedge and then failed below it. Very negative. Price is now at a major support area in the 164-166 zone. If this fails, 155 should come with weaker oil and/or stronger dollar.

Similar idea to Chevron, but not quite as bad. Valero tried to break out above highs at 147 and failed hard. At the end of January, the initial break over the trend line looked good with a chance to take off. But, along with crude and the rest of the oil sector, VLO saw a reversal.

VLO has a little more wiggle room compared to CVX towards the downside. Look for 120-125 to hold. Those levels line up both with the rising support line and major support level at 125. If this fails, 115 then 110 will come into play.

Exxon is the “least” bad of the bunch. Part of the reason it is less dependent on pure oil and has less dollar risk. But it’s on the verge of becoming bad. This rising channel is screaming sell if it breaks below. Exxon is a slower mover than many of the other oil stocks so it may not be a straight down sort of break.

Watch the 105 area. It needs to base around there to hold up. If that level fails, 102 then 100 comes into play sooner rather than later.

Summing it Up:

Oil needs to hold 70-72 or else 61-62 comes into play

needs to hold 164-166

needs to hold 120-125

needs to hold 105

If DXY continues higher and breaks above 105, watch for a further drop in oil and oil stocks