TLDR:

Trades for tomorrow. May update depending on premarket in the morning

$ES_H $SPX

Futures tried to get over the all important 4020 today but failed. We saw a nice pop at the open, but came back down to 4000 and chopped around all day. But, it’s a good sign there’s consolidation and buyers stepping in at the drops. The candlestick doesn’t look great and we need a few more days to get a better idea of what happens next. I’m still bullish until we see negative momentum and break under 3950 area.

Upside: 4020*, 4050, 4080, 4110, 4180*

Downside: 3975, 3950, 3915*, 3860, 3820

And for comparison:

Upside: 399*, 403, 407, 411*

Downside: 390*,387,383*, 378

Looks a bit better candle wise. In a perfect world, we see QQQ break over 285-286 at the same time #ES makes a push over 4100 area with momentum. If that happens on strength, be ready to load up. That will be your queue to take more risk.

Upside: 285*, 293, 297*

Downside: 275*, 270*, 266

BACKTEST TRADE: 134+ backtest take 137c

Watch to see if we get a pullback towards 134+. If that area holds and the market is strong and/or moving sideways, a backtest trade could work. Apple premiums are fairly cheap right now, so a small move can get 30-50%

REJECTION TRADE: 104+ to 105ish rejection 100p

Possibly 102p If trading with size I would go with smallest spread option strike between 99p-102p.

ABNB is coming up to a good sized resistance zone after a big run up. This is a bit of a risky trade since the market and this ticker have shown momentum. I would only take this trade if the market shows weakness or signs of reversing at the time it hits the resistance zone.

Trade Idea: 110c>105.75 Rollup

Crowdstrike had a really strong day. Showed major relative strength and ran straight up most of the day. 108+ to 109 is strong resistance. If entering at 105.75, I would look to take a majority of the position off at those 108-109 levels and wait to see what happens if it can push thru. The option’s premiums are still cheap, so a break over 105.75 up to 108ish should yield 60-75% profit.

REJECTION TRADE: 22ish rejection 20p

Gamestop and the rest of the Meme stocks have been showing strength lately. GME tends to be fairly technically clean. I would watch for a rejection at 22 with relative weakness. In other words, if GME is going up while the rest of the market is going down, this trade wouldn’t work.

Also, watch the 24 level. Another big possible area for a major rejection. If it gets up there tomorrow, I’ll look at the 22.5 put.

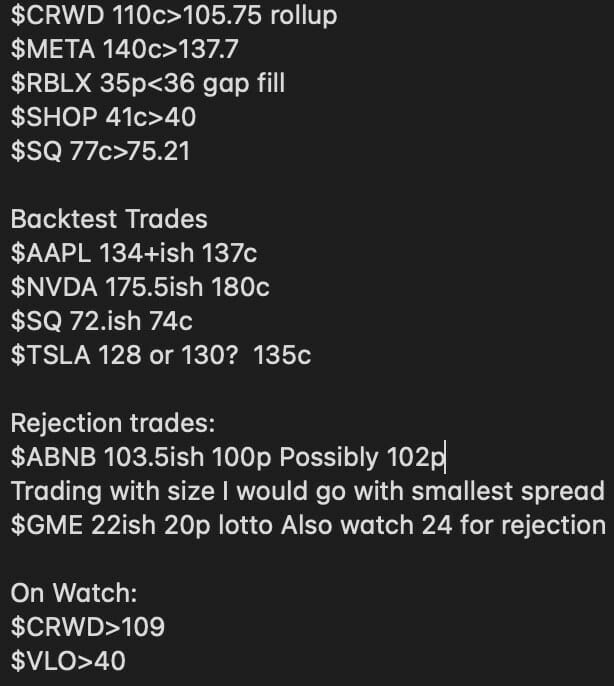

Trade Idea: 140c>137.7

Similar idea to yesterday’s notes…”Looking good and I think there is a lot of room to run if it clears the 137-138 area. Not much overhead supply and we could easily 160 in time with a strong market. Short term this week, if the market is strong, 150 could be in the cards. BUT, if the market reverses and/or 137-138 rejects hard, META could come back down to test 122-125 area. Watch getting shaken out of this one if you go long at 137-138. It could very easily bounce around at 137-138, pullback a bit and shake people out, then rocket off to 145-150. I will most likely size the trade fairly big but be willing to watch the trade lose a bunch and/or make the entry small enough that I can add on a small pullback.”

I don’t like a backtest trade right now. It’s hard to say if we will get consolidation or the bigger pullback like I mentioned above.

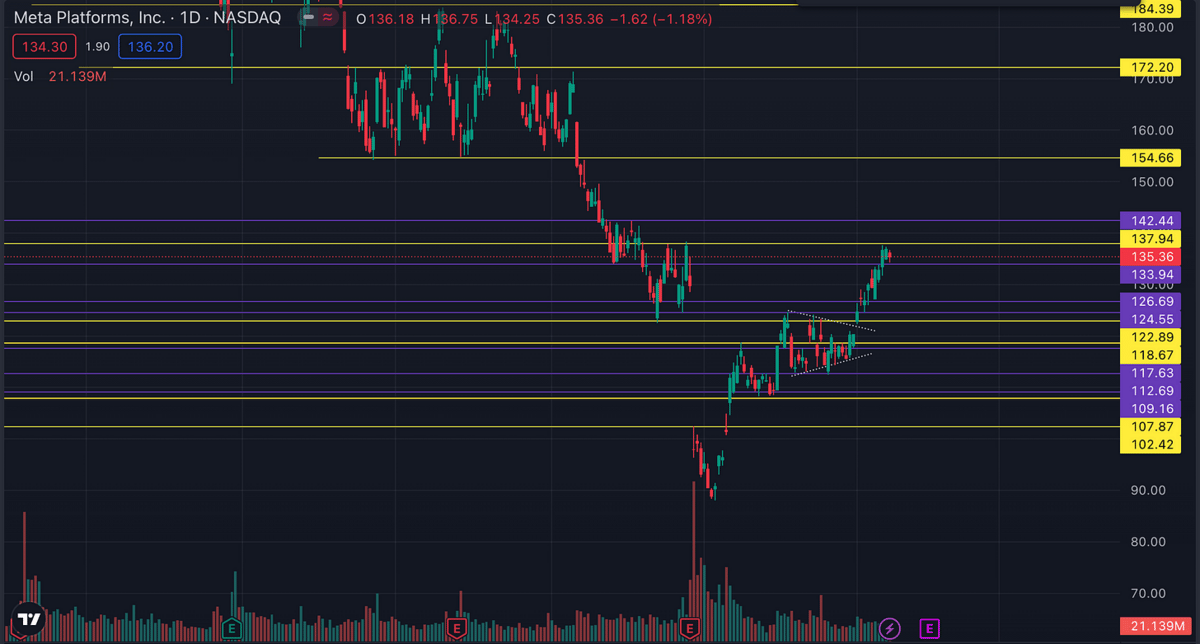

On Watch: Seeing if we backtest 175-176 and hold or break higher over 177. We’ve seen a pretty big move and were coming up to a resistance zone. 2 points may make a trade worth while, however, doesn’t seem worth the risk unless the market shows tons of strength.

Trade Idea: 35p<36

Roblox ran up bigly on positive fundamental news. Depending on how growth stocks fair tomorrow, we could see a reversal on this move with weakness. I’ll be looking to go short under 36 and try for a gap fill.

Trade Idea: 41c>40

Shopify got a bit extended today as it broke over 40. It’s worth another shot tomorrow if it can get back over 40. If we gap up just over 40, I’m willing to see if it comes back down under 40, then retests the 40 breakout. I would like to see all of this happen in the first 5-20 minutes. Otherwise, it may just lead to chop and/or a failed breakout at the 40 level.

Reminder of yesterday’s notes:

“Is Shopify finally going to breakout of this mega base? Looks like its heading that way. 40 is a big resistance level. Could easily fail. I would take a smaller position over 40…but definitely worth a shot. Clearing 42ish this week, should see 45 relatively quick.”

Trade Ideas: 77c>75.21

BACKTEST TRADE: 71.5-72 74c

SQ still looking really good…breaking out the triangle and coming up to supply zones with strength. I think you have multiple options on this one tomorrow. If the market is strong, tech is strong, a breakout over yesterays’s high should give enough of a run to make a 40-50% profit. If it continues over 76, we could see a nice 2x plus trade.

If the market comes down on strength or small pullbacks, another option is to take a backtest trade. 72 was pretty good resistance last week and it should act as support this week. I would size down a bit on a backtest trade given the 72 level isn’t quite proven yet long term.

Tesla showed tons of strength today. Really strong all day, showed plenty of strength at resistance of 130 then bouncing right off support at 128. For me, I don’t love a trade here. I would like to see it setup more. Could work for a scalp, but I like more construction to my trades. If I miss the move, I miss the move. Plenty of fish in the sea.

On Watch: breakout over 140 take 142 call or with weakness at 140 take 138 put

A lot of what happens with Valero will dependent on the crude market. Two options here. Watch to see if we can breakout over 140 on strength both on the ticker and in the crude oil market. It technically looks really good, however, VLO is a slow mover so things don’t always work out if we don’t see some sort of volume come in or strength within the oil sector.

Other option is to take a rejection trade. See if price really slows down and shows signs of reversal or stalling and then take the 138p. In either scenario, you won’t need much movement to make a good profit. 1 point of movement should yield 50% profit or so.