TLDR: Tuesday’s Watchlist is at the bottom of the post.

Monday’s Results:

Today was another tough day for finding quality trades. We saw another gap and grind type of day. The price action played out today simiilary to what we saw last week. Make no mistake. This market is very hard to trade. Don’t be too hard on yourself. Catching runners may not happen in this environment. Find a way to be patient, size down, and take profits sooner. Things will get easier and cleaner. As I mentioned in yesterday’s newsletter, it may take a catalyst even to drive the markets in one direction or the other.

If you are having trouble with patience, figure out different ways to mitigate risk. On my learning journey, I would step away from the screens completely. I learned to accept it’s better to miss one ok to good trade versus taking 3 or 4 bad trades in choppy markets. Find what works for you.

On today’s results, we caught a really nice trade with $CRWD. It was a fairly straightforward trade. The order of events was to ensure the market held up, take the breakout over the trigger level, systematically take profits, and keep some runners. The runners didn’t work out. I exited about flat on the last little bit of the trade.

$META was a loser if you took it. I chose not to take it due to the slow market and $META neither showing relative strength nor relative weakness.

There is a simple check for possible trades in a slow market. See if the ticker is at a higher percentage than its peers and the broader market if in an uptrend and just the reverse in a downtrend.

For tomorrow, expect more of the same. The consumer confidence numbers release happens at 10:00 am EST. That event has a small chance to drive the markets up or down with some momentum. But, we will need to see a big surprise on the print. My guess is we see a pop or a dip on the release and then it goes back to the chop and grind.

Further, unless big volume comes in, I do not foresee big levels being broken with strength. Meaning, we could see more traps at important levels and break out type trades failing.

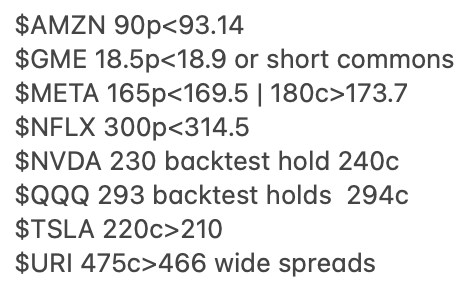

#ES_F S&P 500 Futures

Upside: 4000, 4020, 4050, 4080, 4100-4125, 4180, 4215, 4260, 4300

Downside: 3980-3975, 3950, 3915

Gap and grind. Red bar green bar. Good candle bad candle. Anytime you see this price action, you should default your thinking to “this market sucks.” There may be 1 or 2 tickers on the day that turns into a runner. And it won’t be a 200% type runner. You will be lucky to break 100%.

Try not to get frustrated if you miss the runner of the day. Get used to it. It’s going to happen a lot.

For tomorrow, I have zero idea what to expect other than the possible chop. It looks like the white dotted local uptrend line will hold up. #ES_F needs to get over 4020-4025 if we can get movement upwards.

To the downside, there is still plenty of support. The local uptrend line at about 3950 and, then, the big support at 3900-3915.

Again, unless we big volume and momentum come into the market, I don’t see the important levels of support and resistance breaking cleanly.

$SPY

Upside: 399-400, 403, 407,410-411, 417, 420

Downside: 397, 393, 390, 387

Over the past few weeks, $SPY has more or less been mirroring the S&P Futures E-mini. It looks like we have diverted based on Friday’s and today’s candle. What does this mean?

Not much frankly. It depends on what ticker/instrument you like to watch and trade. It does make things easier when levels are easily matched or correlated. For example, 402ish on $SPY was closely tied to 4020ish on #ES_F.

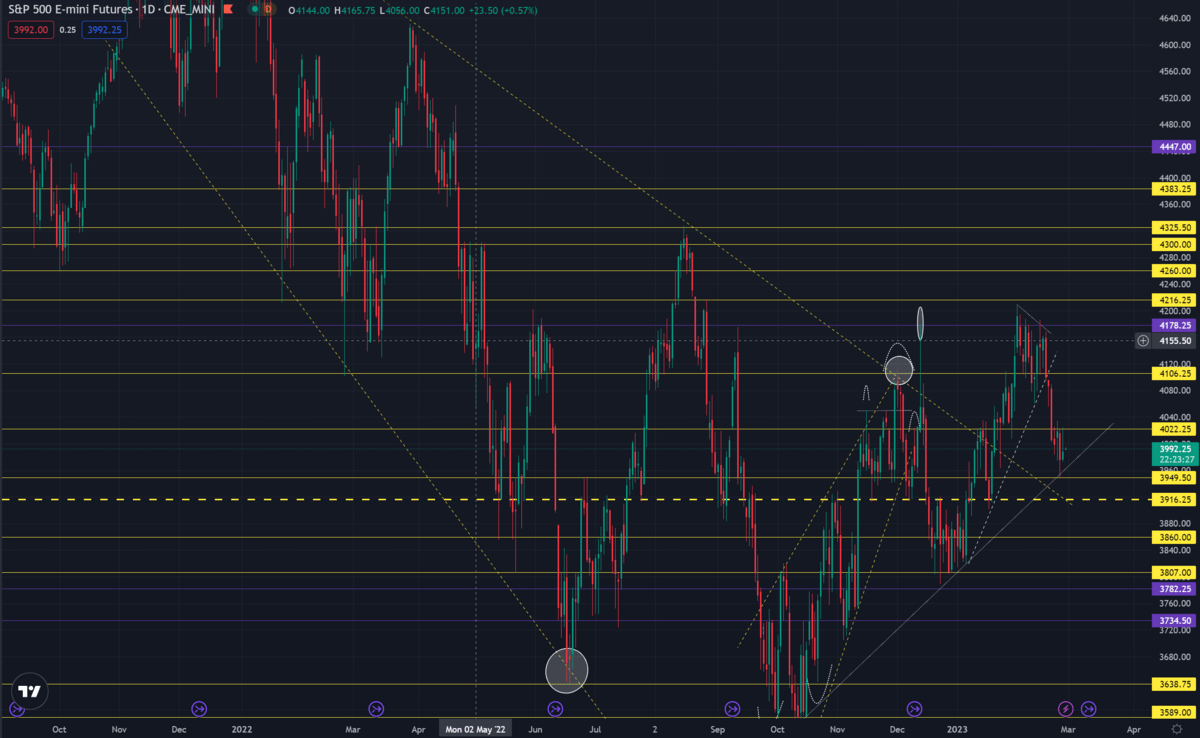

$QQQ

Upside: 297, 302-303, 307, 310, 313

Downside: 293, 289-290, 285-286, 280

Backtest Trade Idea: 293 holds 294c

The NASDAQ is still riding the descending channel. 293 developed into a strong support area in the past few trading days. If 293 holds up tomorrow, we can see it try and push toward the upper side of the channel. Price still needs to clear 297-298 with momentum to break out of the channel. With the chop in the market, we need to take it day by day on the price action and not try to predict. Simply be prepared for what the market gives us and react to that price action.

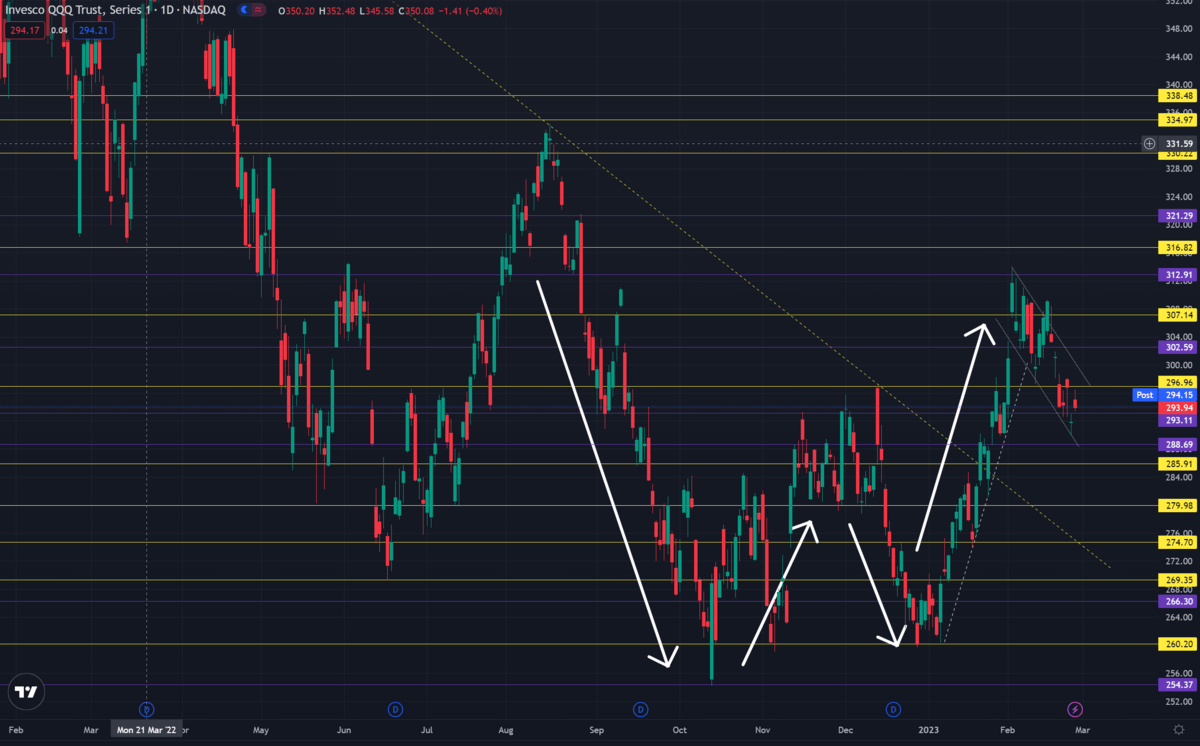

$AMZN

Trade Idea: 90p<93.14

This trade idea takes the entry earlier than yesterday’s 91ish entry. The reason for the earlier entry is the loss in theta plus the low IV. It will only take about a 1-point move to make 40-50% on the trade. A very low risk trade.

If this trade triggers, I’ll watch for Friday’s low at 92.3 to see if the downside move slows or stops. If that happens, I will likely take some profits off the table (assuming the market is slow). After 92, 91.5 should come into play, resulting in plenty of profits.

If you are confused about how this math works, a simple, back of the napkin way to look at it is to take the delta of the 90 put and multiply it by the expected price move divided by your entry. For numbers, price is 0.34×0.37, let’s call it 0.35. Delta is at 0.164. So a 1-point move gives 0.16 then 0.16/0.34×100=47.1% gains.

$GME

Trade Idea: 18.5p<18.9 or short commons small or lotto sized position

GameStop tends to chop in channels when it’s not having a meme movement day. But, when the channels fail or breaks out, the moves are sizable. We don’t want to size up too much on the trade due to the nature of the stock. If the channel fails and moves down hard, the options should see 100% down toward 17. For stops, I will let this trade go to zero without a stop. The other option is to keep a tight stop around 19.6.

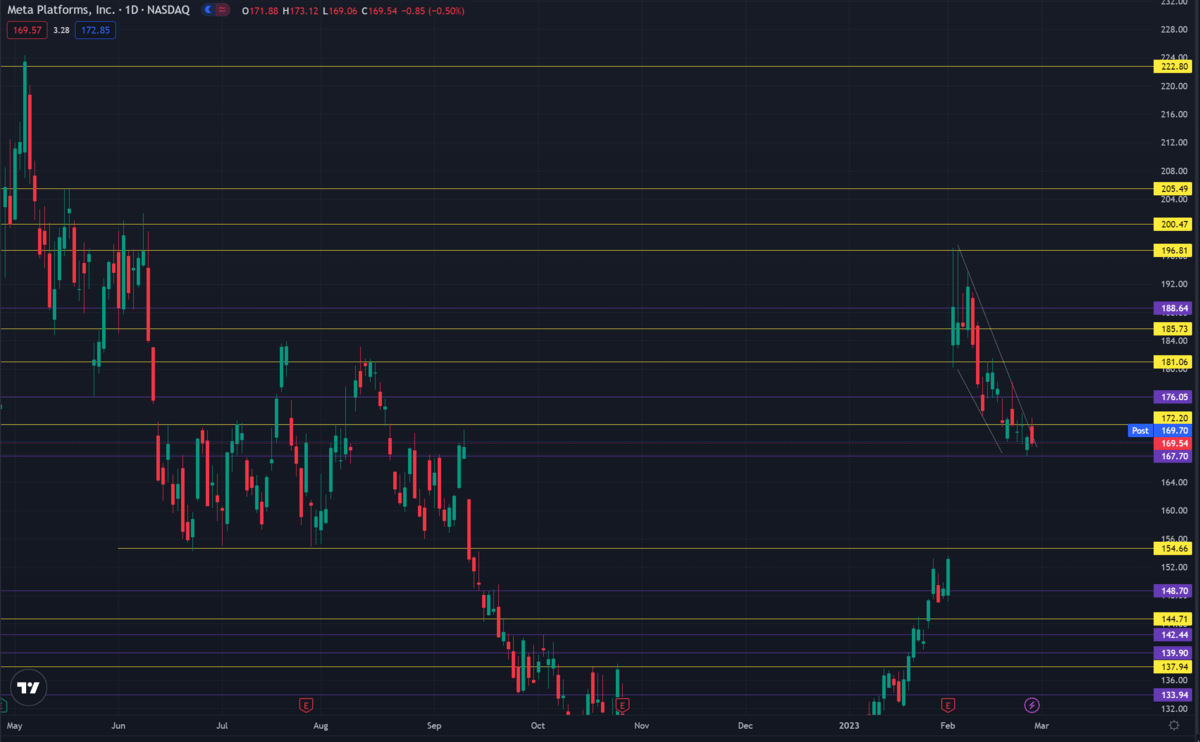

$META

Upside Trade Idea: 180c>173.7

Downside Trade Idea: 165p<169.5

Same idea as yesterday. The short side of the trade failed today due to the slow market. For tomorrow assuming we don’t gap up or down, the downside may do better versus the upside in chop. There is less price movement needed to make the downside trade work. Or in other words, the trade is flipped compared to Monday, where the downside trade may not work because of the gap up at the open.

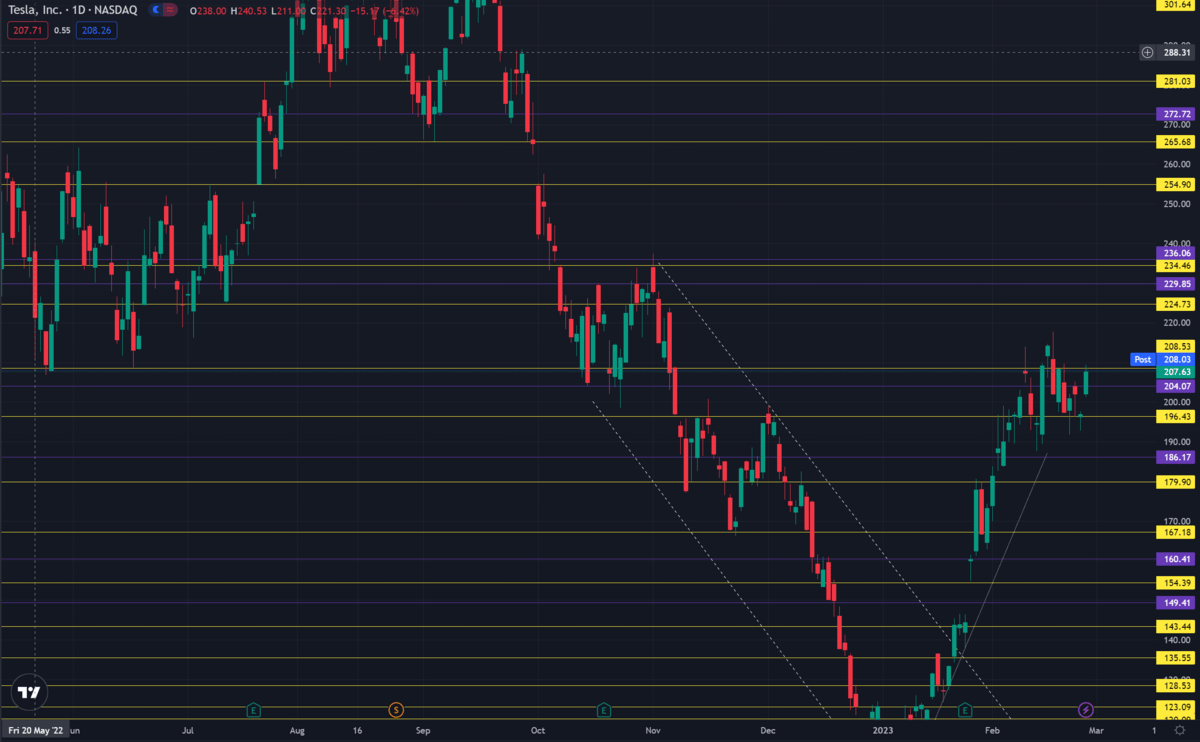

$TSLA

Trade Idea: 220c>210

Tesla showed great relative strength today. The consolidation area from 190-210 is beginning to look more bullish. There is now more of a bull flag/pennant forming.

Now, instead of the downside, I’m looking for an upside trade. Just goes to show how day to day this market moves. Yesterday I was only looking at short trades for $TSLA.

For this trade to work, I want to see similar relative strength as today. If Tesla falls flat on its face tomorrow, this trade will fail or go for a small gain. Your options are to sit it out, plan on taking quick profits, or size it to go after runners. Just be emotionally ok if you get say 10% and go after a runner, but then the trade goes against you and fails.

I’ll probably wait to see how the relative strength is doing compared to tech and the broader market. If Tesla moves like today, that gives me more confidence in going after runners.

$URI

Trade Idea: 475c>466 careful on how the entry limit price is placed with the wide spreads

United Rentals like to give good sized moves consolidate, give another good move, consolidate, etc etc. When the breakout and continuation comes is difficult to judge since it’s a slow mover. But, definitely worth a shot if you can get a good fill.

If the price triggers, receiving a good fill will be the hardest part of this trade. I would not chase too much because overpaying for the option could kill potential profits.

In general, taking more than around a $10k position will be tough. You can either leg in or spread it across multiple strikes if you can time it plus deal with all the button pushing. I’ll keep my size small so I don’t have to deal with too much button pushing. If I don’t get in, I don’t get in.

Remember, wide spreads run into exit fill issues as well. I plan on having most, if not all, of my profit targets, entered once I’m initially in the trade. Set it and forget it. Whatever happens, happens.

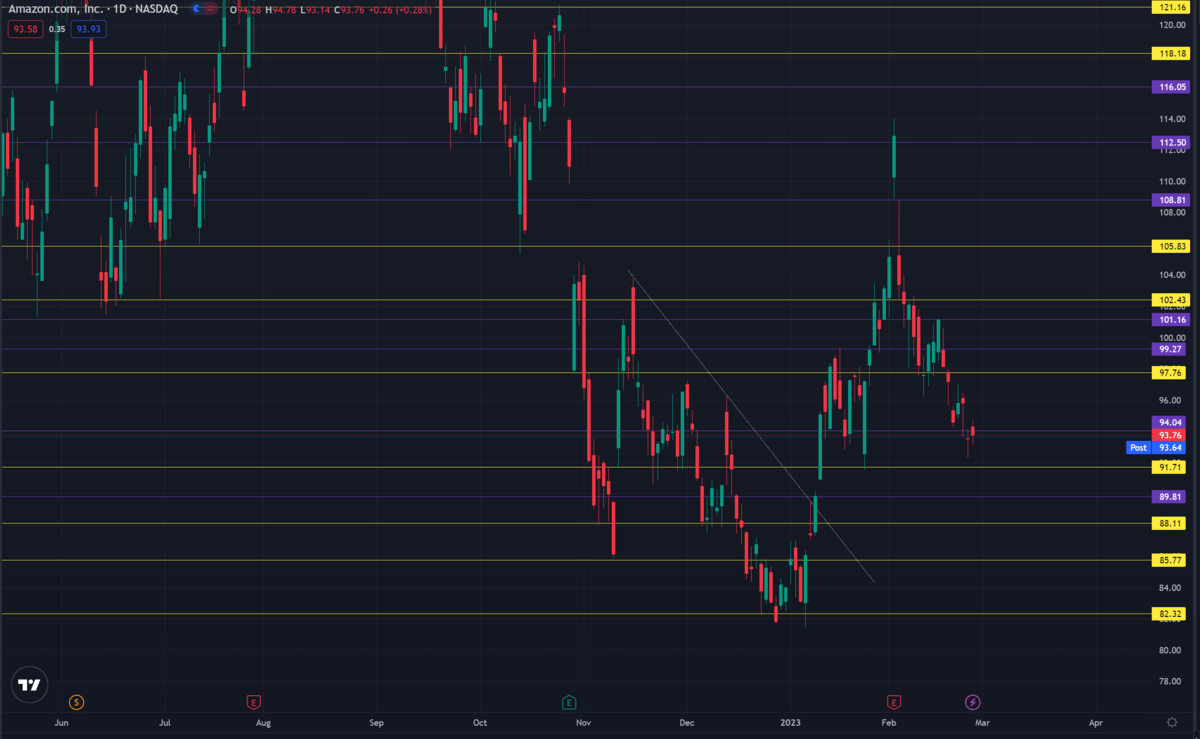

Tuesday’s Watchlist: